2139 Exchange is an online trading platform that has come under scrutiny for its illegal operations and false claims of regulation. Despite its promises of legitimate financial services, the Italian Companies and Exchange Commission (CONSOB) has ordered the blackout of its website due to illegal activities in Italy. Additionally, investigations have revealed that 2139 Exchange falsely claims to be registered with several regulatory bodies, including the Accounting and Corporate Regulatory Authority (ACRA) and the U.S. Securities and Exchange Commission (SEC). Given these red flags, 2139 Exchange presents itself as an unlicensed and untrustworthy platform.

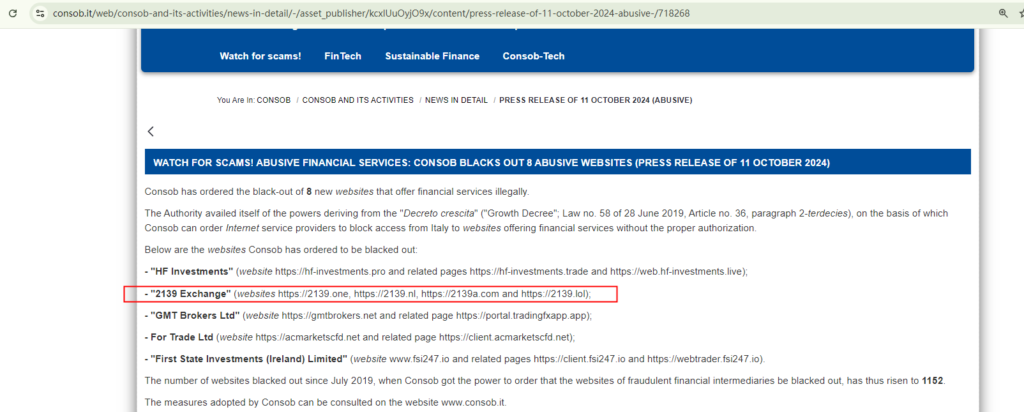

CONSOB Blackout Order

The most alarming development regarding 2139 Exchange is the action taken by CONSOB, the Italian Companies and Exchange Commission. On October 11, 2024, CONSOB ordered the platform’s website to be blacked out because of its illegal provision of financial services in Italy. This action is part of CONSOB’s ongoing effort to combat unlicensed and fraudulent trading platforms that pose a threat to Italian investors. The official press release from CONSOB can be accessed here.

When a national regulator like CONSOB issues such a drastic order, it means that the platform is operating outside the bounds of the law. Investors should take this as a clear warning that 2139 Exchange is not a legitimate financial service provider and is in violation of regulations in Italy. This lack of proper authorization makes the platform highly risky for anyone considering investing their money.

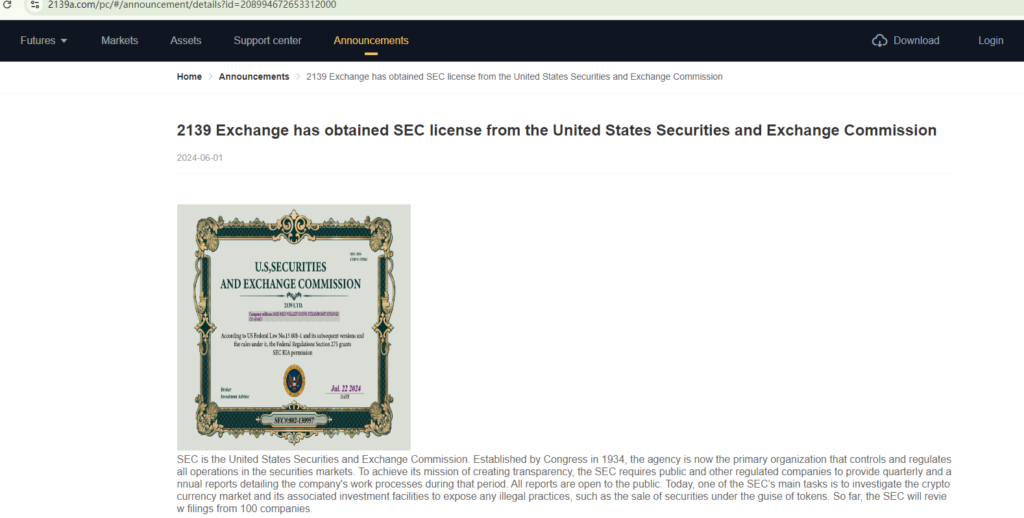

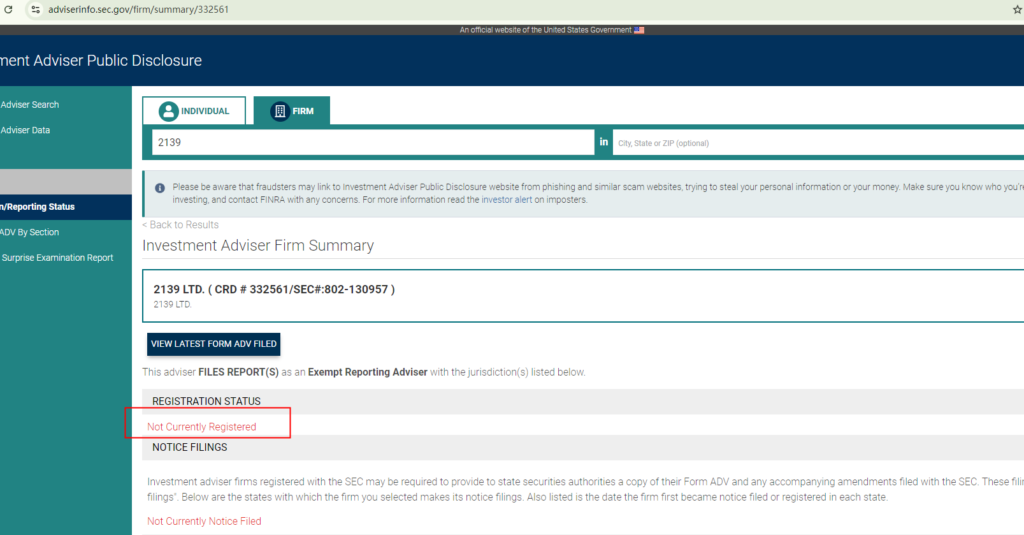

False Claims of Regulation

Another major issue with 2139 Exchange is its misleading claims of being registered with key regulatory bodies. The platform states that it is registered with both the Accounting and Corporate Regulatory Authority (ACRA) in Singapore and the U.S. Securities and Exchange Commission (SEC). However, after further investigation, it has been confirmed that 2139 Exchange is not listed with either of these authorities.

By falsely claiming to be registered with recognized financial regulators, 2139 Exchange is attempting to create an illusion of legitimacy. This deceptive practice is a common tactic used by fraudulent platforms to lure unsuspecting investors into a false sense of security. In reality, the absence of verifiable registration means that 2139 Exchange is not subject to the stringent oversight that regulated platforms must adhere to. As a result, investors have no guarantee that their funds will be managed responsibly or that they will have any recourse in the event of fraud or mismanagement.

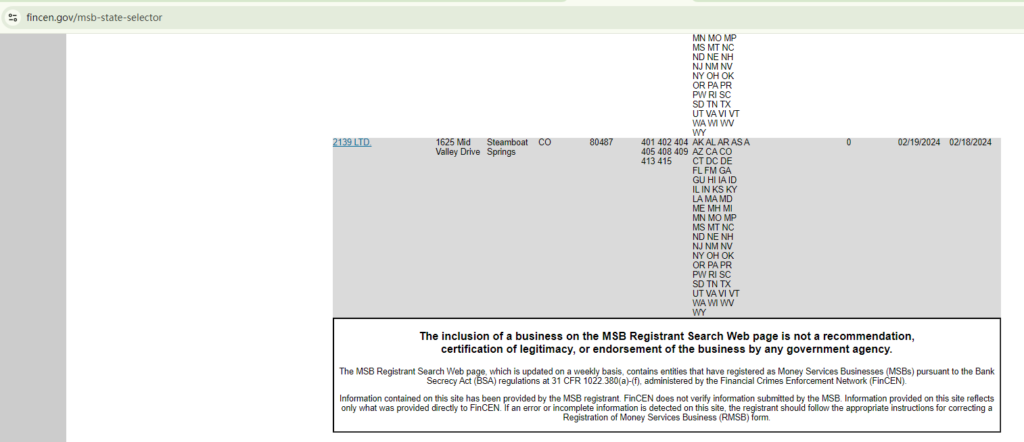

Misleading MSB Registration with FinCEN

2139 Exchange also claims to be registered as a Money Services Business (MSB) with the Financial Crime Enforcement Network (FinCEN) in the United States. While this registration is true, it is important to note that FinCEN registration alone does not imply endorsement or authorization by the U.S. government. MSB registration merely serves as a requirement for certain types of financial service providers but does not guarantee that the platform complies with U.S. financial regulations. Therefore, this claim should not be taken as a sign of legitimacy.

No Legal Safeguards for Investors

Given that 2139 Exchange is not regulated by any recognized financial authority, entrusting funds to this platform is extremely risky. Without proper oversight, investors have no legal protections in place to safeguard their investments. If the platform engages in fraudulent activities or mismanagement, there are no guarantees that investors will be able to recover their money.

In today’s financial landscape, regulation is key to ensuring the safety of investments. Legitimate platforms are subject to strict rules and guidelines, which protect investors from fraud and misconduct. Unregulated platforms like 2139 Exchange, on the other hand, operate with little to no accountability, making them highly dangerous for anyone looking to invest.

Conclusion: 2139 Exchange is a Scam

The CONSOB blackout order, false regulatory claims, and lack of transparency make it clear that 2139 Exchange is an unregulated and risky platform. With no legitimate authorization from financial authorities and a history of deceptive practices, this platform should be avoided at all costs. Entrusting funds to 2139 Exchange could lead to significant financial losses, as there are no legal safeguards in place to protect investors.

Investors should always choose platforms that are fully regulated by recognized financial bodies to ensure the safety and security of their funds. 2139 Exchange, with its history of illegal activity and false claims, appears to be a scam, and engaging with it could lead to serious financial harm.

If you have already invested in 2139 Exchange and are having trouble withdrawing your funds, it is important to report the platform to your local financial regulatory body or Centered Reviews for a chance of recovery and to warn others..