InsideInvest.pro presents itself as a platform for trading in the foreign exchange (forex) market, targeting traders looking for investment opportunities. However, the platform raises significant concerns, particularly regarding its regulatory status and legitimacy. According to a warning issued by the Autorité des Marchés Financiers (AMF), the financial regulatory authority in France, InsideInvest.pro operates without proper authorization. This warning, along with other red flags, highlights why potential investors should be cautious when considering this platform.

AMF’s Warning: InsideInvest.pro Is Unauthorized

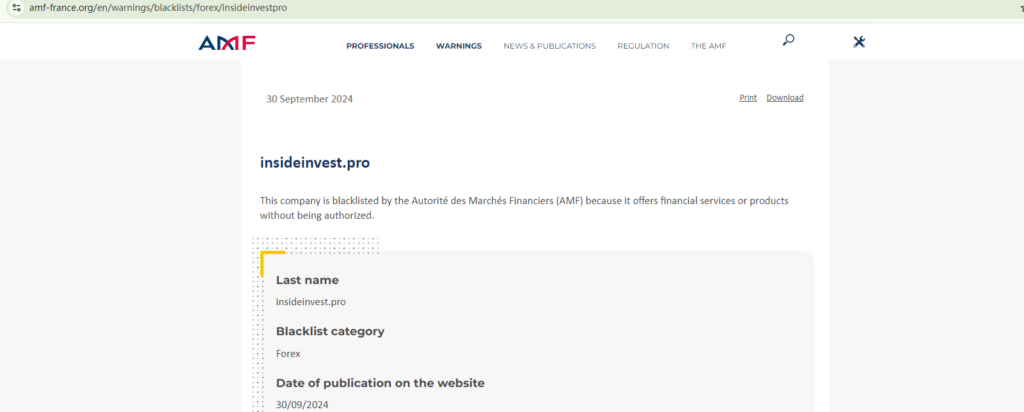

On October 2024, the AMF added InsideInvest.pro to its blacklist of companies engaged in unauthorized forex activities. The AMF’s role is to ensure that financial service providers operating within France adhere to strict regulatory standards designed to protect investors from fraud and mismanagement. Any company offering financial services in France is required to obtain authorization from the AMF or another recognized regulatory body.

The fact that InsideInvest.pro has been flagged by the AMF means it operates outside the bounds of regulation, which is a major cause for concern. Without oversight from a financial authority, the platform can engage in unethical practices, leaving its users vulnerable to potential fraud, unauthorized trades, or the mishandling of funds.

You can read the full AMF warning on InsideInvest.pro here.

Lack of Transparency and Regulatory Information

Another glaring issue with InsideInvest.pro is its failure to provide any verifiable regulatory information on its website. A legitimate trading platform usually provides clear details about the regulatory body overseeing its operations and its license number, which serves as proof of its legal standing. However, InsideInvest.pro does not provide this essential information.

This lack of transparency is a significant red flag. In the highly regulated world of financial markets, transparency is crucial. Regulated brokers must adhere to strict guidelines to protect investors, such as ensuring that client funds are kept separate from company funds and following strict reporting requirements. InsideInvest.pro’s failure to provide proof of regulation leaves potential investors with no legal safeguards, making it highly risky to trust the platform with funds.

High-Risk Environment

Trading with a platform that lacks regulatory approval is inherently dangerous. Investors who choose to engage with InsideInvest.pro are exposed to significant risks, including the possibility of losing their funds with no recourse. Without regulatory oversight, there are no guarantees that the platform is following best practices for security or fair trading.

Furthermore, unregulated brokers like InsideInvest.pro often lure investors with promises of high returns, using aggressive marketing strategies to create a sense of urgency. However, these promises are typically too good to be true, and once investors deposit their funds, they may find it difficult or impossible to withdraw them.

Poor Customer Support and Withdrawal Issues

Many unregulated platforms are known for poor customer service and problematic withdrawal processes, and InsideInvest.pro appears to follow this pattern. Several users have reported difficulties in withdrawing their funds, with the platform citing vague reasons such as additional verification requirements or technical issues. In some cases, users have found their accounts blocked or closed when they attempt to withdraw larger sums.

This lack of accountability and responsiveness further demonstrates the dangers of trading with an unregulated platform. Without the oversight of a regulatory authority, there are no mechanisms in place to ensure that customer complaints are handled properly or that withdrawals are processed in a timely manner.

Conclusion: Stay Away from InsideInvest.pro

InsideInvest.pro is an unregulated, unauthorized broker that poses significant risks to investors. With a warning from the AMF and the absence of any verifiable regulatory information, the platform should be avoided by anyone looking to trade forex or other financial instruments.

When choosing a broker, it is crucial to prioritize platforms that are regulated by recognized financial authorities. Regulated brokers offer transparency, legal protections, and accountability, all of which are essential to protecting your investments. InsideInvest.pro, by contrast, offers none of these safeguards, making it a highly risky and untrustworthy option for traders.

If you have already deposited funds with InsideInvest.pro or suspect fraudulent activity, report your case to your local financial regulatory authority. You can also share your experience on review platforms like Trustpilot or Centered Reviews to help warn others about the dangers of using this platform.

It is a scam! Be careful! Company is using the FCA fake profiles to charge you VAT amount (in crypto!) during withdrawal process! Real FCA will never do it. I have an official statement from the UK authority. They will push you to verify your wallet by non-sense payment (15-20% from withdrawal amount), but it is their additional income from you. They will never send you money back, even though these funds never been invested.

Everything looks great during investment phase, including the communication from broker (in my case Daniel Asti), but when you decided to withdraw your funds including profit, problems will start and you will never receive money..

So many broker websites like this that seems very legit but it’s all fake or greedy brokers. My advice is run but if you’re already a victim. I was a victim but it all ended in praise.

Almost lost over $32,900 and I noticed some group of people are seriously taking this scam game as means of survival.