MC Markets is an online trading platform that claims to provide access to various financial instruments, including Forex, commodities, stocks, and cryptocurrencies. While the platform attempts to present itself as a legitimate and trustworthy trading service, a deeper investigation into its regulatory status reveals serious issues that investors should be aware of. Specifically, the claims of regulation made by MC Markets are either unverifiable or misleading, making it a highly risky platform to trust with your funds.

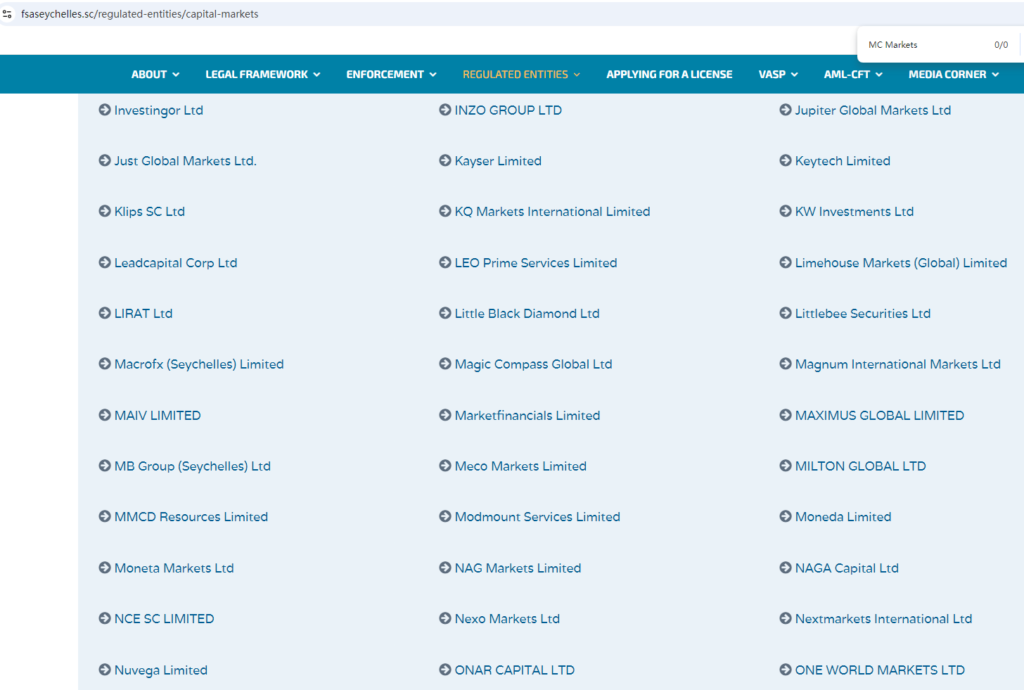

False Regulatory Claims: Seychelles Financial Services Authority (FSA)

According to its website, MC Markets claims to be regulated by the Seychelles Financial Services Authority (Seychelles FSA). Regulation by a financial authority is a critical factor for the legitimacy of any trading platform, as it ensures the company follows specific guidelines and offers protections to its clients. However, upon investigating the Seychelles FSA register, no matching information was found that would confirm MC Markets’ regulatory status with this authority.

This is a significant red flag because being falsely associated with a regulatory body undermines the platform’s credibility. Investors are led to believe that their funds are being held with a secure, regulated entity, when in fact, no such oversight exists. Without regulation from a legitimate financial authority, MC Markets is free to operate without adhering to necessary financial standards or offering any real protection to its clients.

Misleading MSB Claim: Not a Forex Regulator

MC Markets also claims to be regulated by Money Services Business (MSB), a financial regulatory body that oversees money transfers and currency exchanges. However, it’s crucial to understand that MSB does not regulate foreign exchange or any other types of financial trading services like Forex, stocks, or commodities. MSB primarily deals with money transfer businesses, such as Western Union or PayPal, and has no authority to oversee complex financial services such as those provided by trading platforms.

This misleading regulatory claim further demonstrates that MC Markets is not transparent about its actual status. Investors might be falsely reassured that their funds are safe, when in fact, MSB does not regulate the core services MC Markets offers. This lack of transparency about regulatory oversight is a major concern, as it leaves traders exposed to potential fraud, mismanagement, or loss of funds without any recourse.

The Risks of Trading on Unregulated Platforms

One of the most concerning aspects of using an unregulated platform like MC Markets is the absence of legal protections. When a trading platform is not regulated by any financial authority, there are no enforceable rules in place to protect clients’ funds. For example, regulated brokers must segregate client funds from company assets, which ensures that even if the company goes bankrupt, clients’ money is safe. This is not the case with MC Markets, which can use clients’ funds however it sees fit.

Additionally, unregulated platforms often engage in unfair practices, such as making it difficult for clients to withdraw funds or introducing hidden fees that eat away at profits. The lack of accountability and oversight means that MC Markets could close its doors at any moment, leaving investors without any way to retrieve their money.

Other Warning Signs

Besides the misleading claims about its regulatory status, MC Markets also raises concerns due to its lack of transparency in other areas. The platform provides very little information about its company structure, the people behind the company, or even its physical address. This anonymity is a major red flag, as legitimate financial companies are typically open about their ownership and business operations.

Furthermore, client reviews and reports suggest that many users have experienced difficulties when trying to withdraw funds from MC Markets. Delays in processing withdrawals, high withdrawal fees, and poor customer service are common complaints, further highlighting the potential risks involved in using this platform.

Conclusion: Avoid MC Markets

In conclusion, MC Markets is an unregulated trading platform that makes false claims about its regulatory status. The platform’s association with the Seychelles FSA is unverifiable, and its claim to regulation by the Money Services Business (MSB) is irrelevant to the services it offers. These deceptive practices, coupled with a lack of transparency and reported difficulties in withdrawing funds, make MC Markets an extremely risky option for investors.

Without any form of regulation, there are no protections in place to safeguard clients’ money, and the platform could disappear at any time, leaving traders with significant financial losses. For these reasons, investors are strongly advised to avoid MC Markets and seek out reputable, regulated brokers that offer the necessary security and oversight to protect their funds.