TEDX Limited claims to be a financial services provider operating in the UK, offering various investment opportunities to potential clients. However, there are serious concerns about the legitimacy and safety of this platform. The Financial Conduct Authority (FCA), the primary financial regulator in the UK, has issued a warning about TEDX Limited, stating that the company might be providing financial services or products without proper authorization. This warning, combined with the platform’s lack of regulation and transparency, suggests that TEDX is a highly risky and potentially fraudulent entity.

FCA Warning and Lack of Authorization

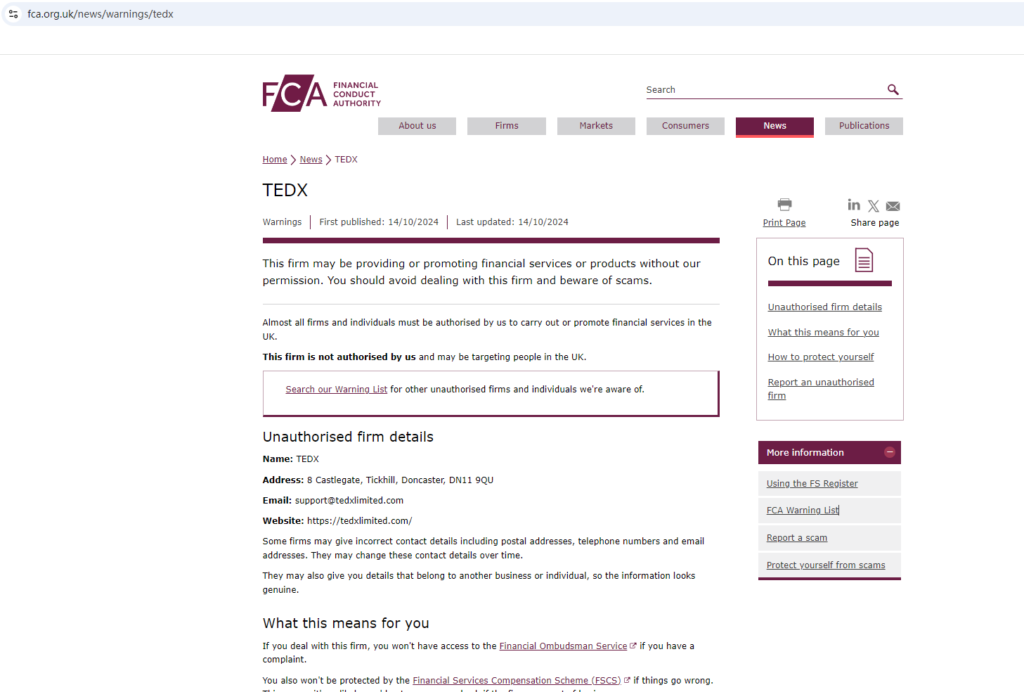

One of the most significant issues with TEDX Limited is the warning issued by the Financial Conduct Authority (FCA). The FCA regulates financial firms in the UK, ensuring that companies meet strict standards designed to protect consumers. On September 29, 2024, the FCA publicly warned against TEDX Limited, believing that the company was offering financial services or products in the UK without proper authorization. The FCA’s warning can be viewed here.

When a company is not authorized by the FCA, it means that it is not subject to the same oversight and regulatory requirements as legitimate financial service providers. This lack of regulation leaves investors without any legal protections, increasing the risk of financial loss. The FCA’s warning is a strong indicator that TEDX Limited may not be a trustworthy entity, as it is not following the regulatory standards required to operate legally in the UK.

Lack of Regulation

The fact that TEDX Limited operates without being regulated by any recognized financial authority is a major concern. Regulation is crucial in the financial industry, as it provides a layer of security and accountability. Regulated companies must adhere to strict guidelines, including transparency about their operations and safeguarding clients’ funds. In contrast, unregulated firms, like TEDX, are not held to these standards, meaning they can operate with little to no oversight.

Without regulation, investors have no assurance that TEDX Limited will handle their funds responsibly. In the event of any wrongdoing, such as fraud or mismanagement, there are no legal avenues for investors to recover their money. This creates a highly risky environment for anyone considering using the platform.

Transparency Issues

Another critical issue with TEDX Limited is its lack of transparency. The company’s website provides little to no detailed information about its operations, leadership, or regulatory status. This lack of transparency makes it difficult for potential investors to understand who they are dealing with or how their funds will be managed. Legitimate financial firms are typically open about their regulatory status, leadership team, and business practices, allowing investors to make informed decisions.

In the case of TEDX, the absence of clear and detailed information raises red flags. Investors should always be cautious when dealing with a company that withholds critical information, as this could indicate that the company is attempting to hide something.

Risks of Entrusting Funds to TEDX Limited

Given the FCA’s warning and the lack of regulation, entrusting funds to TEDX Limited is highly risky. Without the protections offered by regulatory oversight, investors are vulnerable to fraud, mismanagement, or even the complete disappearance of the platform. In recent years, there has been a growing number of online investment scams, and unregulated platforms like TEDX are often involved in such schemes.

Investors should avoid platforms that are not regulated by reputable authorities like the FCA. Without legal protections in place, the risks far outweigh any potential rewards that TEDX may promise. The combination of the FCA’s warning and the platform’s lack of transparency makes it clear that TEDX Limited is not a safe option for investors.

Conclusion: Avoid TEDX Limited

Based on the FCA’s warning and the lack of regulatory oversight, TEDX Limited appears to be a highly risky and untrustworthy investment platform. The absence of proper authorization and the company’s lack of transparency suggest that it is not operating in the best interest of investors. For those considering investing with TEDX, it is strongly advised to avoid the platform and seek out regulated, reputable alternatives that offer legal protections and transparency.

Investors should always prioritize platforms that are fully authorized by recognized regulatory bodies, as this ensures that their funds will be protected and managed responsibly. TEDX Limited, with its unregulated status and FCA warning, appears to be a scam, and engaging with this platform could lead to significant financial losses.

If you have already invested in TEDX Limited and are having trouble withdrawing your funds, it is important to report the platform to your local financial regulatory body or Centered Reviews for a chance of recovery and to warn others..