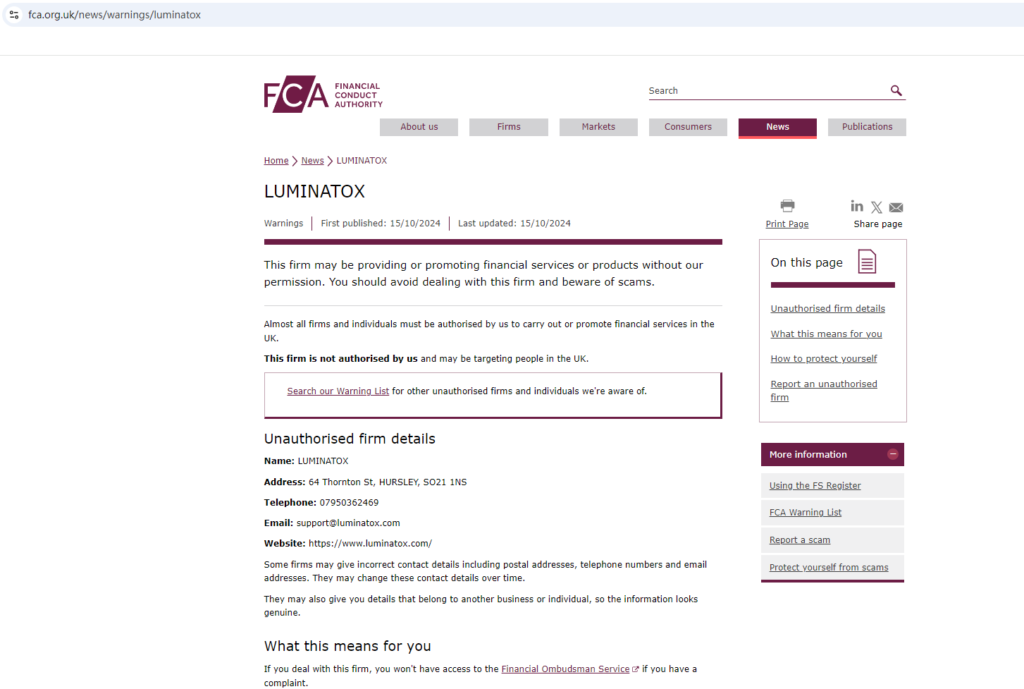

Luminatox claims to provide financial services and promises investment opportunities. However, its lack of regulatory authorization raises serious concerns. The Financial Conduct Authority (FCA) has issued a warning against Luminatox, citing that the company might be offering financial products or services without proper authorization. The FCA warning is a major red flag for anyone considering using the platform.

FCA Warning and Lack of Authorization

The FCA, the regulatory body responsible for overseeing financial markets in the UK, has raised alarms about Luminatox. According to the FCA’s public warning, Luminatox is providing financial services or products without the necessary authorization. You can view the FCA warning here.

This lack of authorization indicates that Luminatox is not regulated by the FCA, which means the company is not subject to the stringent rules and standards required of legitimate financial service providers in the UK. When a company operates without FCA oversight, investors are left vulnerable to potential fraud, as there are no legal protections in place to safeguard their investments.

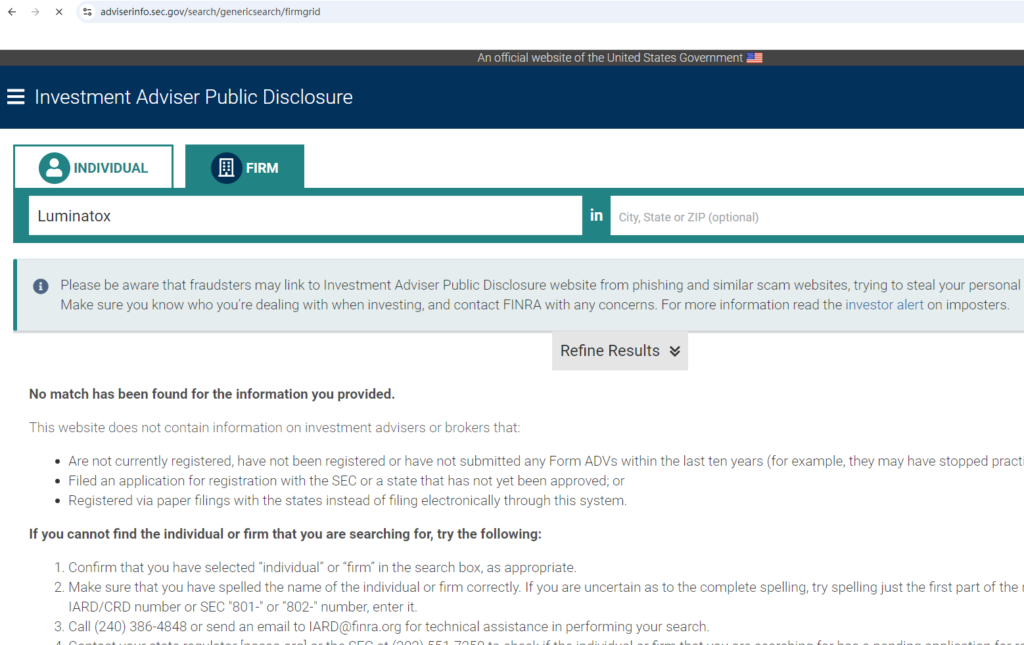

False Regulatory Claims

Luminatox’s website claims that the company is regulated by the Securities and Exchange Commission (SEC) in the United States. However, after a thorough investigation, no matching information could be found in the SEC’s official database. This false regulatory claim is a significant red flag, as it shows that Luminatox may be deliberately misleading potential investors.

Regulation by the SEC is essential for companies offering financial services in the U.S. It ensures that firms adhere to strict rules that protect investors from fraudulent activities. Luminatox’s unsubstantiated claim of SEC regulation further suggests that the company is not a legitimate operation. For investors, this kind of misleading information signals that they should stay away from the platform.

Lack of Legal Protections

Since Luminatox is not regulated by any governing financial authority, there are no legal protections for investors. Regulation provides a level of oversight that ensures companies are transparent and accountable for their actions. Without it, companies can operate without any consequences for fraudulent behavior or mismanagement of funds.

For those who choose to invest with Luminatox, the risks are incredibly high. If something goes wrong—such as the company disappearing with investor funds—there are no legal avenues for recovering lost money. Entrusting your funds to an unregulated entity like Luminatox is akin to putting your money into a black hole, where you have no assurance of safety or accountability.

Risk of Fraud

Unregulated platforms like Luminatox are often involved in fraudulent schemes. Given the FCA’s warning and the false claims of regulation by the SEC, it is highly likely that Luminatox could be a scam. Fraudulent platforms typically lure investors in with promises of high returns, only to disappear once they have collected enough funds. With no regulation in place, there is little stopping Luminatox from engaging in such practices.

Conclusion: Luminatox is a High-Risk Platform

Based on the FCA’s warning, Luminatox’s false claims of regulation, and the overall lack of transparency, it is clear that this platform is highly risky for investors. The company operates without any legal protections, making it a dangerous place to entrust your funds. The combination of unregulated status and potential fraudulent behavior suggests that Luminatox may be a scam.

Investors should steer clear of Luminatox and opt for platforms that are fully regulated by recognized financial authorities. Without regulation, there is no way to ensure the safety of your investments, and the risks far outweigh any potential rewards.

If you have already invested in Luminatox and are having trouble withdrawing your funds, it is important to report the platform to your local financial regulatory body or Centered Reviews for a chance of recovery and to warn others..