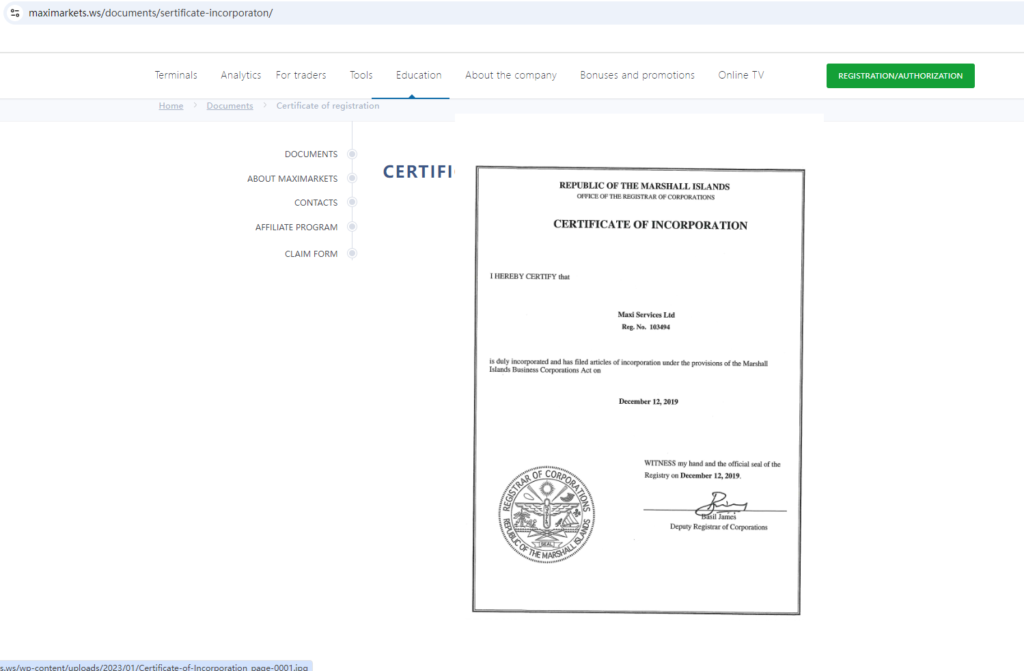

MaxiMarkets.ws claims to be a reliable online trading platform, offering a range of financial instruments, including forex, commodities, and cryptocurrencies. The platform’s website asserts that it is regulated by the Marshall Islands Registry (IRI), which at first glance may provide some reassurance to unsuspecting investors. However, upon further investigation, it becomes evident that this regulation is nothing more than a facade designed to lend legitimacy to the platform.

The Marshall Islands Registry: Not a Real Regulatory Body

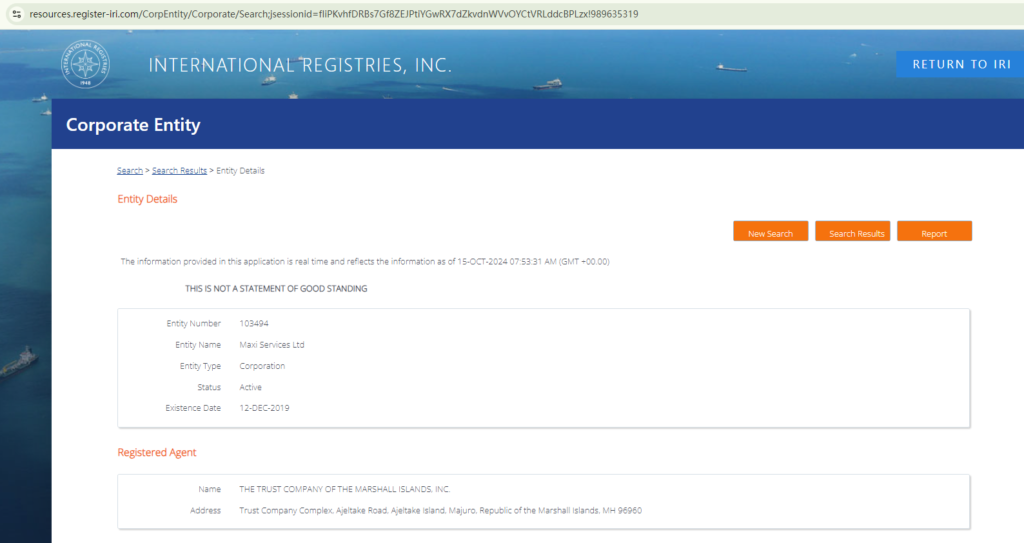

The claim that MaxiMarkets.ws is regulated by the Marshall Islands Registry (IRI) is misleading. While the IRI does indeed provide company registrations, it does not have the authority to regulate financial markets or trading platforms. The IRI is primarily concerned with ship registration, and the entities it registers are not subjected to the stringent regulatory oversight required for financial services firms. Simply put, being registered with the IRI is not a guarantee of compliance or protection for investors.

Furthermore, the Marshall Islands does not have the infrastructure or legal framework in place to regulate foreign exchange, trading platforms, or other financial institutions. This lack of regulation leaves investors vulnerable, as MaxiMarkets.ws is essentially operating without any real oversight. If issues arise, such as disputes over funds or questionable trading practices, investors have no regulatory authority to turn to for assistance.

No Real Regulation: A Major Red Flag

In the world of online trading, regulation is crucial for ensuring the security of funds and transparency in operations. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), or the U.S. Commodity Futures Trading Commission (CFTC) require firms to adhere to strict guidelines. These guidelines include the segregation of client funds, transparency in pricing, and ensuring fair trading practices. Regulated brokers are also part of compensation schemes, offering investors a layer of protection in the event of the firm’s insolvency or fraudulent activity.

However, MaxiMarkets.ws is not registered with any such legitimate regulatory authority. The platform’s reliance on a registration with the Marshall Islands rather than a recognized financial regulator should be seen as a red flag. Without regulation, MaxiMarkets.ws is not bound by any laws or obligations to protect investor funds, leaving investors exposed to potential losses with little to no recourse.

The Risk of Fraud and Lack of Accountability

Given that MaxiMarkets.ws is unregulated, the risks associated with using the platform are substantial. Unregulated brokers have been known to engage in a variety of fraudulent activities, including manipulation of trading data, refusal to allow withdrawals, and outright theft of client funds. In the absence of regulatory oversight, these brokers operate with impunity, as there is no governing body to hold them accountable for their actions.

If a problem arises with MaxiMarkets.ws, such as an inability to withdraw funds or questionable trading practices, investors will have no legal recourse. Regulated brokers must adhere to strict financial regulations and are subject to audits, ensuring that clients’ funds are properly safeguarded. This is not the case with MaxiMarkets.ws, as the platform operates entirely outside the scope of any legitimate regulatory framework.

Warning Signs of a Scam

There are several indicators that suggest MaxiMarkets.ws may be operating a scam. First, the platform’s deceptive claims of regulation by the Marshall Islands Registry suggest that the operators are attempting to create a false sense of legitimacy. Additionally, the lack of transparency surrounding the company’s ownership and operations further undermines its credibility. Legitimate brokers are typically open about their corporate structure, leadership, and regulatory status, whereas MaxiMarkets.ws provides minimal information, making it difficult to determine who is behind the platform or where it is based.

Another common tactic of fraudulent brokers is to lure investors with promises of high returns or easy trading conditions. These promises are often too good to be true and are designed to attract inexperienced traders. Once funds are deposited, these platforms may make it difficult or impossible for investors to withdraw their money, using various stalling tactics or outright refusing to release funds.

Conclusion: MaxiMarkets.ws is Not a Trustworthy Broker

In conclusion, MaxiMarkets.ws is not a trustworthy broker. The platform’s reliance on a Marshall Islands registration instead of legitimate regulation is a clear indicator that it is operating outside the law. Investors who choose to engage with this platform are taking on significant risks, as their funds are not protected by any regulatory framework. The lack of oversight and transparency, combined with deceptive marketing practices, strongly suggests that MaxiMarkets.ws is a scam.

Investors are urged to avoid this platform and seek out brokers that are properly regulated by recognized financial authorities. Regulatory oversight is essential for protecting client funds and ensuring fair trading practices, and any broker that operates without it should be viewed with extreme caution.

If you have already invested in MaxiMarkets.ws and are having trouble withdrawing your funds, it is important to report the platform to your local financial regulatory body or Centered Reviews for a chance of recovery and to warn others..