OTC Europa, which operates through websites like otceuropa.com, otceuropa.info, and otc-500.support, advertises itself as a provider of financial and investment services. According to its website, the company has offices in both the United States and Switzerland, potentially to attract international investors by suggesting a broad global reach. However, an investigation reveals that OTC Europa does not hold any authorization from the relevant financial regulatory bodies in these countries. Furthermore, a recent warning from Germany’s Federal Financial Supervisory Authority (BaFin) highlights that OTC Europa is operating without the required authorization, raising serious concerns about its legitimacy and intentions.

BaFin Warning and Regulatory Concerns

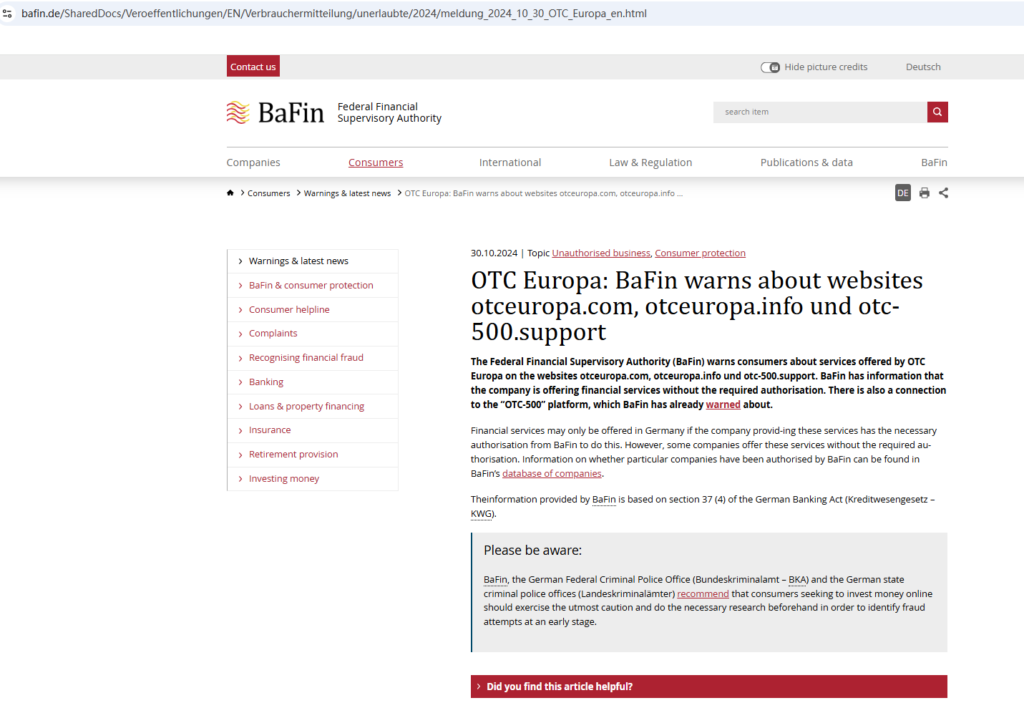

On October 30, 2024, BaFin issued a consumer warning regarding OTC Europa, explicitly stating that the company is providing financial services in Germany without the necessary authorization. This warning, accessible on BaFin’s official website, underscores that OTC Europa is not a regulated entity and is therefore not bound by the regulatory requirements that ensure transparency, accountability, and investor protection. Operating without oversight from BaFin means OTC Europa is likely sidestepping important legal standards, which could leave investors without recourse in case of issues with the platform. You can view BaFin’s warning here.

BaFin’s alert signals that OTC Europa operates outside Germany’s regulatory framework, allowing it to operate in a way that does not prioritize client protection, compliance, or ethical practices. If problems arise, such as disputes over fund withdrawals or unexpected fees, investors are left vulnerable as OTC Europa is not legally accountable.

Unverified Claims of US and Swiss Offices

In addition to the BaFin warning, an independent review by BrokersView highlights that OTC Europa is unregulated, which is concerning given the company’s claims of legitimacy. While the website states that OTC Europa has offices in the United States and Switzerland, there are no records of the company in the registries of either the National Futures Association (NFA) in the United States or the Swiss Financial Market Supervisory Authority (FINMA). These omissions suggest that OTC Europa has no regulatory footprint in these countries, making its operations potentially unauthorized and deceptive.

Regulated platforms must follow strict standards in each region, including fair treatment of investors, transparent fund management, and adherence to financial laws. Without verifiable licensing in the US, Switzerland, or Germany, OTC Europa does not provide the legal protections that ensure investor security and trust.

Potential Red Flags and Risk Factors

Several factors about OTC Europa indicate a high level of risk for investors:

False Claims of Office Locations and Regulation

By claiming office locations in regulated jurisdictions like the US and Switzerland, OTC Europa implies legitimacy and oversight that do not exist. Investors could be misled into believing the company is regulated when, in reality, no regulatory authority holds it accountable for its practices.Lack of Transparent Terms and Policies

OTC Europa provides limited information on its terms and policies. Regulated brokers typically disclose clear terms and fees, ensuring investors understand their commitments and potential risks. The lack of transparency on OTC Europa’s part could conceal hidden fees, withdrawal restrictions, or other unfavorable conditions that place investors at a disadvantage.High Return Promises

OTC Europa advertises potentially high returns on investments, a common tactic used by unregulated platforms to attract investors. Promises of high or guaranteed returns are typically unrealistic, especially from a platform lacking regulatory oversight. This strategy often serves as a red flag that the company is more interested in drawing in deposits than delivering on its promises.

Safer Alternatives for Investors

To ensure protection and security, investors are encouraged to choose regulated platforms that hold verifiable licenses from authorities like BaFin, FINMA, the NFA, or other reputable bodies. Licensed brokers must comply with regulatory requirements that prioritize investor protection, transparent fees, and the fair treatment of clients. By verifying a platform’s registration on regulatory websites, investors can avoid the risks associated with unregulated brokers like OTC Europa.

Conclusion

OTC Europa’s lack of licensing with BaFin, FINMA, and the NFA, combined with BaFin’s warning, strongly suggests that the platform is untrustworthy. With unverifiable regulatory claims, a lack of transparency, and high-return promises, OTC Europa exhibits the hallmarks of a potentially fraudulent scheme. Investors are strongly advised to exercise caution and seek regulated alternatives that offer legal protections and a commitment to ethical practices. Entrusting funds to OTC Europa poses significant risks without the safety net provided by legitimate, regulated financial institutions.

If you have already invested in OTC Europa and are having trouble withdrawing your funds, it is important to report the platform to your local financial regulatory body or Centered Reviews for a chance of recovery and to warn others..