Apex Investments, operating under the domain apexinvestments.io, presents itself as a new entrant in the online trading scene. Having registered its domain in April 2024, Apex Investments claims to offer a range of investment opportunities. Despite its ambitious marketing, this platform lacks essential details about its corporate structure and legal authorization. Basic information, such as the company’s physical location, legal status, and regulatory credentials, is conspicuously absent from the site, raising serious concerns about its credibility.

CNMV Warning

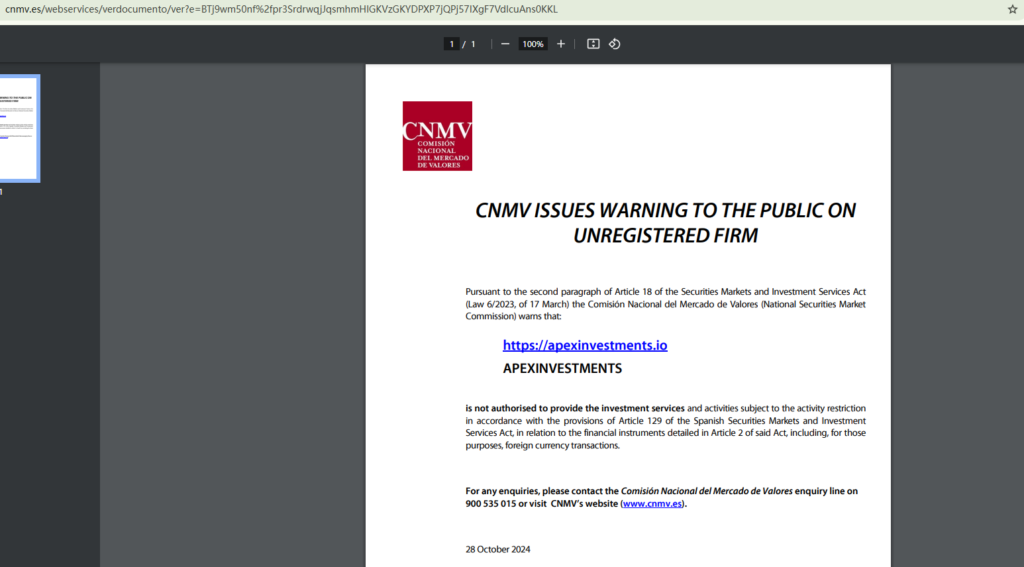

The Comisión Nacional del Mercado de Valores (CNMV), Spain’s financial regulatory authority, has added Apex Investments to its warning list for unauthorized provision of financial services. This alert, available for review here, serves as a caution to investors. The CNMV’s warning indicates that Apex Investments does not hold the necessary licenses to provide investment services within Spain. This means that investors utilizing the platform have no protection from local regulatory oversight.

Warnings from regulators like the CNMV should not be ignored. Financial authorities conduct thorough investigations before issuing such alerts, and being listed on the CNMV warning list signals that a company operates without essential authorization. For Apex Investments, this lack of regulatory endorsement implies a high level of risk for users, who may face challenges recovering their funds or seeking support in case of disputes.

Lack of Transparency

Apex Investments fails to disclose critical information that legitimate financial platforms typically provide to establish trust with potential investors. The platform provides no registered address, fails to name its management team, and omits legal details that could confirm its business legitimacy. Additionally, there is no mention of regulatory affiliation with any financial authority in Europe or abroad.

Without regulatory oversight, Apex Investments operates without accountability, creating a risk-laden environment for its users. Investors cannot verify who operates the platform, their qualifications, or their commitment to protecting client interests. Transparent platforms tend to disclose these details to assure investors that they meet high regulatory standards, a practice that Apex Investments entirely bypasses.

Website and Presentation Quality

Apex Investments relies on broad, generic claims about investment success and potential profits, but its website lacks any detailed explanations or resources about its actual services. The site structure is basic and includes minimal educational resources, tutorials, or tools that reputable brokers offer. This minimal effort suggests the platform might prioritize attracting funds over delivering a quality service experience.

Moreover, the platform’s user interface and design appear unrefined, lacking the professionalism and polish found in trustworthy financial websites. This can often indicate a company that is either newly set up or primarily focused on attracting quick funds rather than providing reliable services.

Risks and Investor Safety Concerns

Entrusting funds to an unregulated entity like Apex Investments presents significant risks. Without regulatory oversight, the platform can alter withdrawal policies, delay processing times, or block user accounts without any obligation to rectify issues. Users on unregulated platforms have limited recourse in case of problems, making Apex Investments a particularly risky option.

Given that Apex Investments does not report to any financial authority, investors using this platform have no assurances of fund security. Regulated platforms are required to follow strict financial standards, including fund segregation and transparency protocols that protect client assets, which unregulated platforms like Apex Investments are not obligated to uphold.

Conclusion

Apex Investments lacks the transparency, regulatory backing, and professional credibility that investors should demand in a trading platform. With the CNMV warning and an absence of basic operational information, the platform poses severe risks. Potential investors are strongly advised to seek regulated and transparent platforms to protect their assets.

In essence, Apex Investments operates without regulatory oversight, making it a high-risk platform. Investors should exercise extreme caution and avoid entrusting funds to this company, given the substantial risks and lack of protections in place.

If you have already invested in Apex Investments and are having trouble withdrawing your funds, it is important to report the platform to your local financial regulatory body or Centered Reviews for a chance of recovery and to warn others..