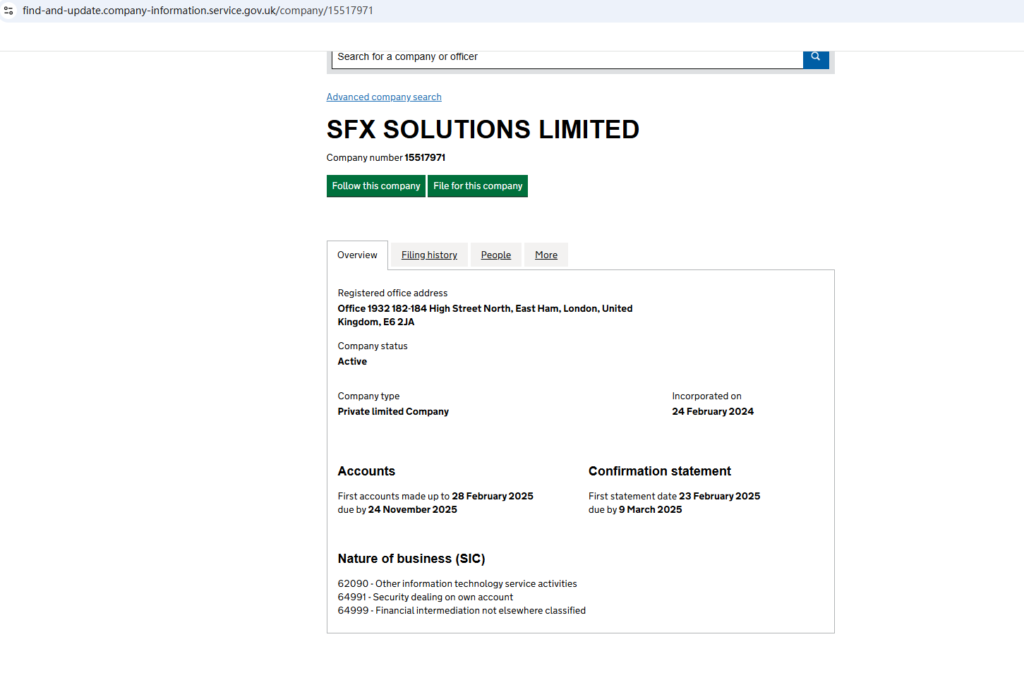

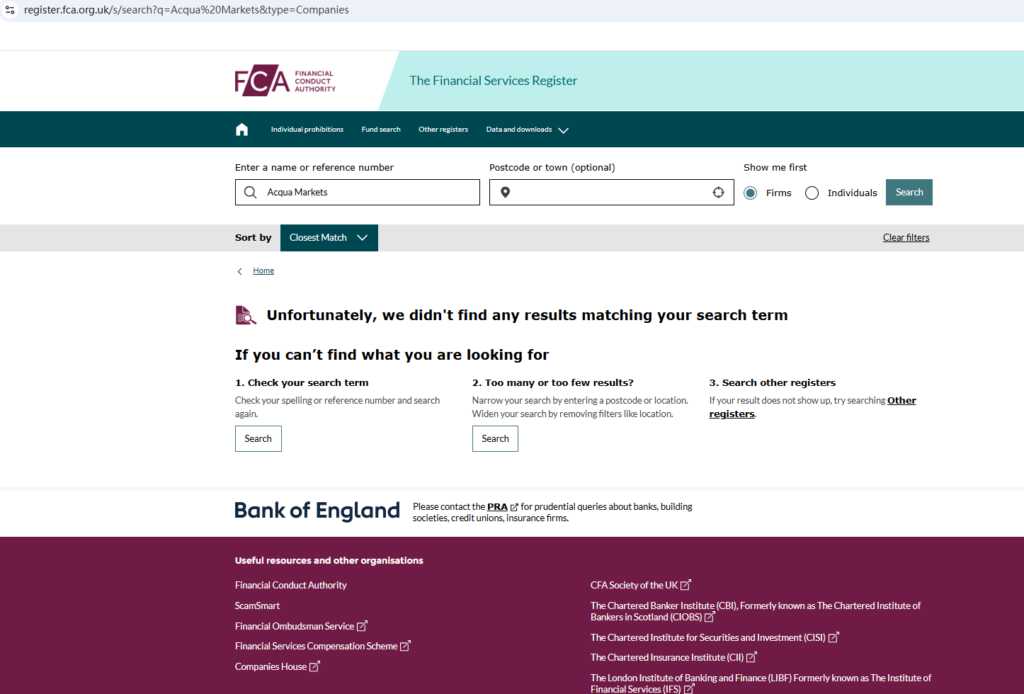

Acqua Markets claims to be a UK-based brokerage, offering various trading opportunities in Forex, indices, commodities, and other markets. Its website highlights its supposed registration with Companies House (CH) and presents itself as a regulated entity. However, while Acqua Markets does have a CH registration number, this does not automatically authorize it to provide financial services in the UK. In the UK, foreign exchange or brokerage services require authorization from the Financial Conduct Authority (FCA), which Acqua Markets lacks. This gap in regulation raises serious concerns about the company’s legitimacy and investor safety.

Companies House Registration vs. FCA Authorization

On its website, Acqua Markets showcases its Companies House registration as proof of its legitimacy. Companies House only verifies a business’s incorporation in the UK and is not a financial regulatory body. In fact, CH registration does not authorize any financial services, as these require explicit FCA approval. In the UK, the FCA oversees all companies offering financial services, including brokerages, ensuring they comply with rigorous standards, client fund protections, and transparency requirements. Therefore, Acqua Markets’ lack of FCA authorization points to an inability to meet these basic regulatory standards, which are designed to protect investors from fraud and mismanagement.

High-Risk Factors Due to Lack of Regulation

Unregulated brokers like Acqua Markets present significant risks to investors. Without FCA regulation, Acqua Markets is not bound by rules such as fund segregation, transparent pricing, or regular audits, all of which safeguard investors. The FCA’s standards for regulated brokers include measures for transparency, client fund security, and dispute resolution processes. Unfortunately, unregulated brokers are not required to adhere to these, leaving investors vulnerable. Acqua Markets’ claim of a CH registration is insufficient to assure investors of security or fair trading practices, highlighting the potential for unsafe or unreliable handling of funds.

Transparency Concerns and Red Flags

Acqua Markets fails to provide crucial contact information such as a physical office address or valid customer service phone number, making it challenging for investors to verify its operations. Additionally, the platform does not disclose essential regulatory documents or financial protections for client funds. Transparency is essential for a trustworthy financial entity, and Acqua Markets’ lack of open, accessible company details is a major red flag. Reputable brokers typically make this information easily accessible to foster trust and demonstrate legitimacy. Acqua Markets’ lack of transparency and oversight should caution potential investors against engaging with this platform.

Final Verdict on Acqua Markets

Despite its claims of UK registration, Acqua Markets operates without FCA authorization, placing investors at significant financial risk. Without FCA oversight, it is highly unlikely that Acqua Markets provides adequate investor protection, making it susceptible to financial mismanagement or even fraud. Investors looking for safe and transparent financial services should opt for FCA-regulated brokers with proven records of compliance and customer protections.

In conclusion, Acqua Markets exhibits characteristics typical of high-risk platforms, including limited transparency, no regulatory oversight, and ambiguous company information. Potential investors should exercise extreme caution, as engaging with Acqua Markets may lead to financial losses without any recourse.

If you have already invested in Acqua Markets and are having trouble withdrawing your funds, it is important to report the platform to your local financial regulatory body or Centered Reviews for a chance of recovery and to warn others..