Meyer Vermögens Welt Finance (MVW-Finance), operating via the website mvw-finance.com, presents itself as a Swiss-based brokerage offering financial services to retail investors. However, despite these claims, the platform has raised substantial red flags regarding its legitimacy. On its website, MVW-Finance lacks basic transparency, failing to disclose critical information, including valid regulatory details or a physical office address. This absence of vital company information has led to scrutiny from the Swiss Financial Market Supervisory Authority (FINMA), which warns against interacting with this unregistered entity.

FINMA Warning and Regulatory Concerns

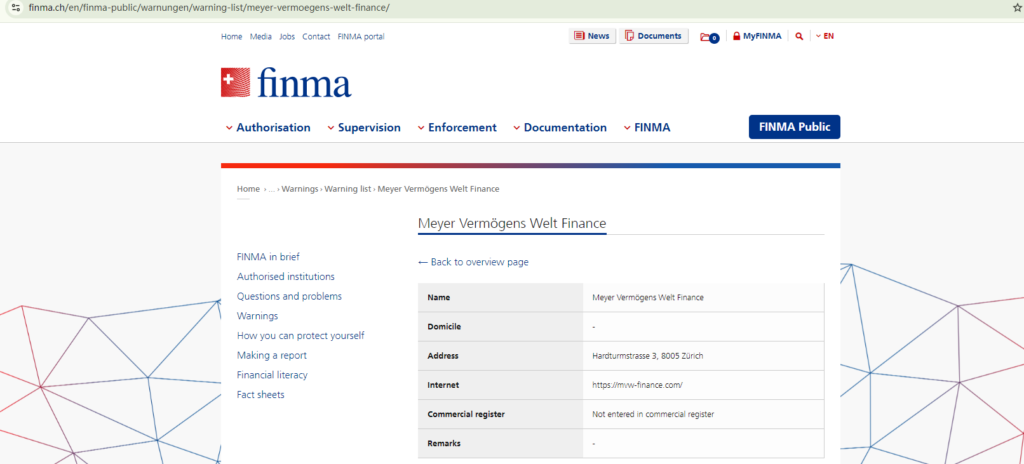

For any company providing financial services in Switzerland, registration with FINMA is mandatory to legally offer its services and assure investors of compliance with Swiss financial regulations. Meyer Vermögens Welt Finance is notably absent from the FINMA commercial register, as highlighted in the warning issued by FINMA here. FINMA’s alert specifically cautions that MVW-Finance operates without proper authorization, indicating that its activities fall outside Switzerland’s regulatory framework.

Without FINMA regulation, Meyer Vermögens Welt Finance is not obligated to follow industry standards designed to protect investors, such as fund segregation, client transparency, or operational audits. Its lack of oversight means clients risk losing funds without recourse should the platform cease operations or mismanage client assets.

Absence of Transparency and Credibility Issues

Transparency is one of the most critical indicators of a legitimate financial services provider. However, MVW-Finance offers minimal information about its ownership, management, or operational structure. The platform also lacks a customer support number or a physical address, which further erodes trust. This absence of essential details can lead investors to conclude that MVW-Finance is hiding pertinent information, possibly to avoid accountability. Furthermore, legitimate brokerages typically display regulatory documentation and licensing details on their websites, while MVW-Finance does not, suggesting it might be an untrustworthy entity.

High-Risk Factors and Investor Safeguard Concerns

Since Meyer Vermögens Welt Finance operates outside any regulatory oversight, investing through this platform carries a heightened level of risk. In Switzerland, regulated brokers must adhere to specific rules regarding client fund security, operational transparency, and dispute resolution. MVW-Finance, however, lacks any regulatory backing, leaving investors without protection should issues arise. The platform’s unregulated status implies that clients have no guarantee of fair trade execution, fund safety, or transparency, exposing them to significant potential financial loss.

Final Verdict on Meyer Vermögens Welt Finance

MVW-Finance shows multiple red flags, including a lack of regulatory approval, limited transparency, and FINMA’s explicit warning. The absence of legitimate authorization highlights that this platform may not prioritize investor protection or ethical business practices. These factors collectively indicate that Meyer Vermögens Welt Finance could be a high-risk, potentially fraudulent entity.

In conclusion, Meyer Vermögens Welt Finance, despite its claims, is not a regulated or safe option for investors. Anyone considering this platform should be extremely cautious and seek alternatives regulated by recognized authorities to ensure their funds’ security and compliance with financial regulations.

If you have already invested in Meyer Vermögens Welt Finance and are having trouble withdrawing your funds, it is important to report the platform to your local financial regulatory body or Centered Reviews for a chance of recovery and to warn others..