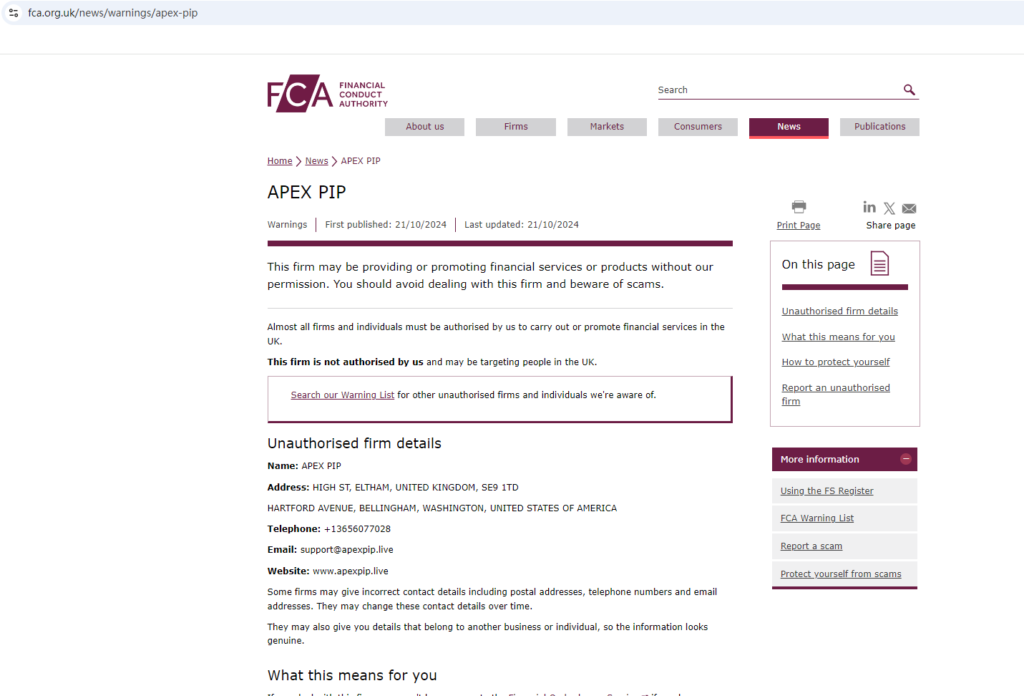

Apexpip.live markets itself as a promising financial services provider, claiming to be based in the United States and regulated in the UK. However, a closer examination reveals significant concerns about the platform’s legitimacy. The United Kingdom Financial Conduct Authority (FCA) has issued an official warning against APEX PIP, raising red flags regarding its operations. You can find the FCA’s warning here.

Lack of Proper Regulation and Authorization

A key issue with Apexpip.live is its lack of proper authorization from regulatory bodies. On its website, the company claims to be regulated by the UK authorities, but this claim does not hold up under scrutiny. According to the FCA, APEX PIP is not authorized to provide financial services in the UK. The FCA is responsible for regulating financial companies to protect consumers, and its warning suggests that APEX PIP may be operating illegally.

This absence of FCA authorization should be a major concern for potential investors. Without regulatory oversight, Apexpip.live is not bound by the same rules and protections that legitimate financial firms must adhere to. For example, the company is not required to segregate client funds from its operational accounts, putting investors’ money at a higher risk of being misused or lost.

Misleading Claims About US Operations

In addition to falsely claiming UK regulation, Apexpip.live also states that it is based in the United States. However, no matching information about the company was found in the National Futures Association (NFA), the primary regulatory body for futures and derivatives markets in the US. If Apexpip.live were truly operating in the US, it would need to be registered with the NFA to offer financial products to American customers.

The lack of NFA registration raises more red flags, suggesting that the platform’s claims about its US base are likely fabricated. Without regulatory oversight in either the US or the UK, Apexpip.live operates in a legal gray area, offering no protections to investors.

Common Scam Tactics and Website Issues

In addition to the lack of regulation, there are other warning signs that Apexpip.live may be a scam. The company’s website uses a design template commonly associated with fraudulent platforms, featuring vague promises of high returns with minimal risk. The site also lacks key details about the company’s leadership, operational history, or legal standing, all of which are crucial for transparency in the financial industry.

The absence of clear and verifiable information about the company’s physical location and team members is another red flag. Legitimate financial firms typically provide detailed information about their office locations, executive teams, and licensing. Apexpip.live provides none of this, which casts further doubt on its credibility.

Investor Risks and Conclusion

The risks of investing in Apexpip.live are substantial. Without regulatory oversight from the FCA, NFA, or any other governing body, there is no legal recourse for investors if something goes wrong. If the platform were to collapse or disappear with client funds, recovering those assets would be nearly impossible.

In conclusion, Apexpip.live appears to be a high-risk, unregulated platform. The FCA’s official warning, combined with the platform’s lack of transparency and misleading claims, suggests that Apexpip.live may be operating as a scam. Investors should avoid this platform to protect their funds and seek out legitimate, regulated investment opportunities instead.

If you have already invested in Apexpip.live and are having trouble withdrawing your funds, it is important to report the platform to your local financial regulatory body or Centered Reviews for a chance of recovery and to warn others..