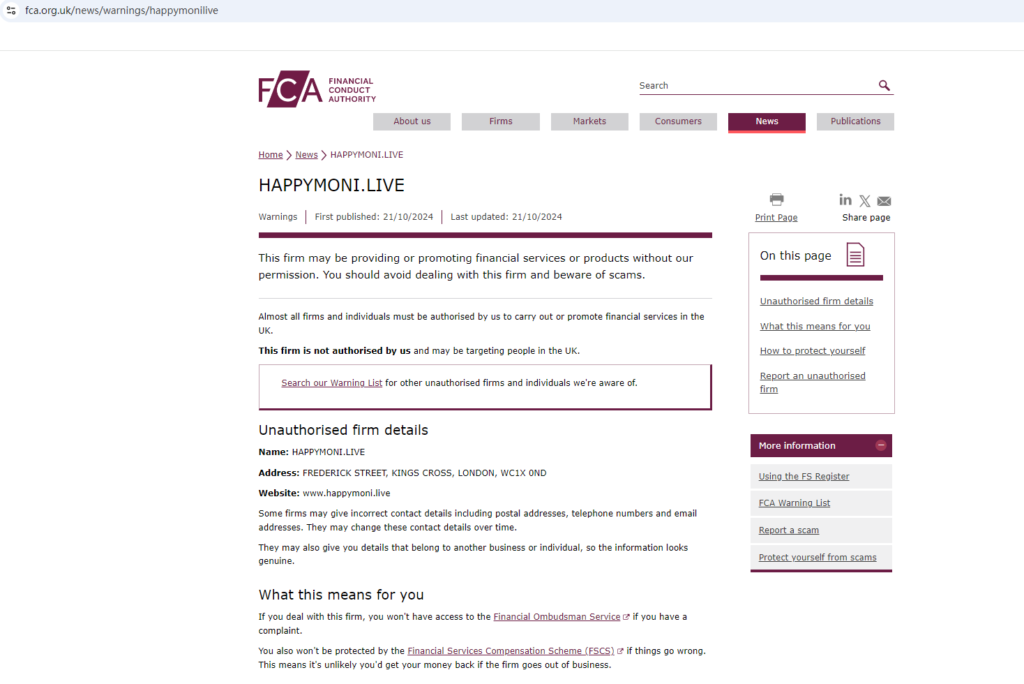

Happymoni.live presents itself as a UK-based financial services provider offering various investment products. However, the platform raises significant concerns regarding its legitimacy and reliability. Most notably, the United Kingdom Financial Conduct Authority (FCA) has issued an official warning against Happymoni.live, cautioning that the platform may be operating in the UK without the necessary authorization. You can view the FCA’s warning here.

FCA Warning and Lack of Authorization

One of the primary concerns with Happymoni.live is its lack of regulatory oversight. The FCA is the UK’s financial regulatory body, responsible for ensuring that companies providing financial services operate in accordance with strict laws to protect consumers. Happymoni.live does not have the required FCA authorization to offer its services in the UK, as confirmed by the FCA warning.

This lack of authorization is a major red flag because it indicates that the platform is not subject to the same rules and regulations that legitimate investment firms must follow. Without FCA oversight, Happymoni.live is free to operate without adhering to important financial guidelines, such as keeping client funds in segregated accounts or following specific transparency standards. This puts investors’ funds at extreme risk.

Suspicious Claims and Lack of Transparency

On its website, Happymoni.live claims to be based in the UK, but there is no verifiable office address or contact information that could be found. The absence of a physical location or reliable contact details is another warning sign. Legitimate companies, especially those dealing with investments, typically offer clear, verifiable information about their location, regulatory status, and leadership team. Happymoni.live fails to provide this essential transparency, making it harder for investors to verify its claims.

Additionally, the platform’s website is quite basic, using a standard template often seen with online scams. There are no details about the company’s ownership or its history, raising further doubts about its authenticity. Combined with the FCA warning, this makes Happymoni.live highly suspicious.

The Risks of Unregulated Investment Platforms

The risks of investing in unregulated platforms like Happymoni.live cannot be overstated. When a company is unregulated, investors have no legal recourse if something goes wrong. In the case of Happymoni.live, if the platform were to suddenly disappear with investors’ funds, it would be nearly impossible to recover those assets.

Legitimate investment firms are required by law to follow strict guidelines, including segregating client funds from their operational funds and being transparent about their financial operations. Companies like Happymoni.live, which operate without regulation, are free to mishandle or even steal client funds without facing any legal consequences.

Final Verdict: Happymoni.live is a Scam

Based on the FCA’s warning and the significant red flags surrounding its operations, Happymoni.live appears to be a scam. Investors should avoid this platform entirely to protect their assets and avoid falling victim to fraud.

If you’re considering investing in any platform, always check its regulatory status with trusted authorities like the FCA. For more information on the FCA’s warning about Happymoni.live, you can visit the official FCA page here.

In conclusion, Happymoni.live is not a safe or trustworthy platform. Without regulatory oversight or transparency, investors are at high risk of losing their funds. Stay cautious and opt for regulated and well-established financial platforms that offer proper safeguards and legal protections.

If you have already invested in Happymoni.live and are having trouble withdrawing your funds, it is important to report the platform to your local financial regulatory body or Centered Reviews for a chance of recovery and to warn others..