CenturyCrypto.net presents itself as a trading platform with offices in both the UK and the US, offering cryptocurrency investment services and products. Despite this ambitious claim, the platform lacks clear regulatory documentation. After investigating further, major red flags emerged regarding its operational legitimacy and regulatory standing. It appears that CenturyCrypto may not have the authorization required to conduct financial services in these regions, making it a high-risk choice for investors.

FCA Warning Against CenturyCrypto

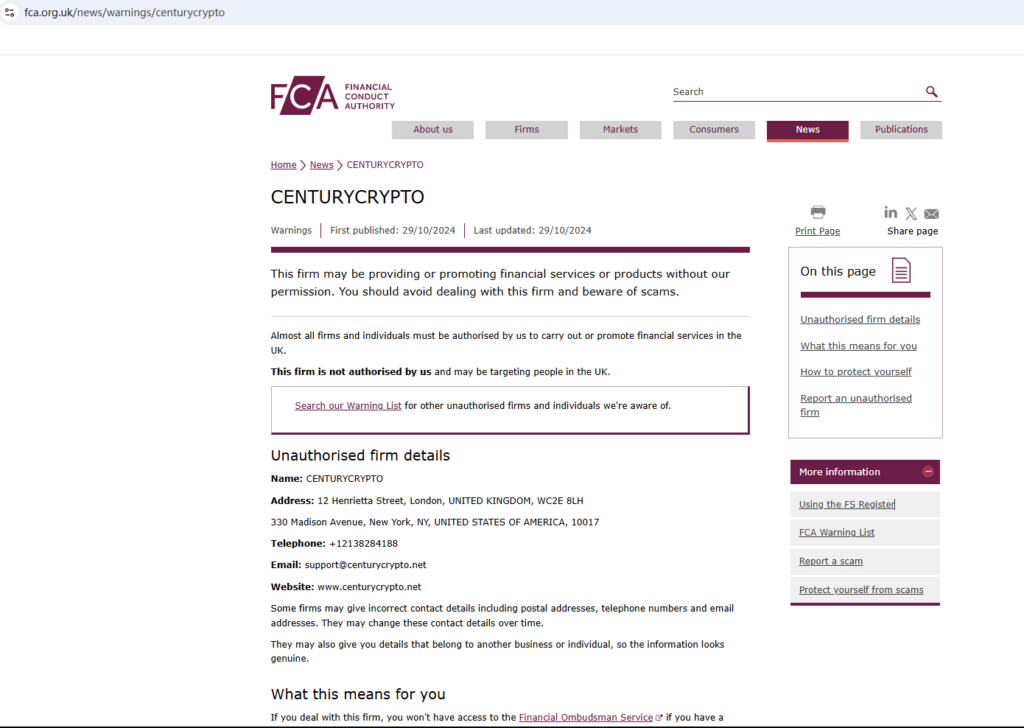

The United Kingdom Financial Conduct Authority (FCA), a primary regulatory body for financial services in the UK, has issued a warning against CenturyCrypto. The FCA has flagged CenturyCrypto for potentially providing financial services or products without the necessary authorization. This caution can be viewed on the FCA’s official website here.

The FCA only issues warnings after careful examination, meaning that CenturyCrypto’s practices do not meet the basic requirements for legal operation in the UK. Investors should note that unauthorized platforms are not subject to the UK’s strict financial guidelines. This lack of oversight opens users up to higher levels of risk, as unregulated entities are not obligated to follow client-protection protocols such as transparent pricing, fair practices, or efficient fund handling.

Lack of US Registration

CenturyCrypto also claims to have an office in the United States; however, no record of the platform or its supposed operator exists in the National Futures Association (NFA) database. This absence suggests that CenturyCrypto lacks any official recognition or registration within the US financial regulatory framework, which raises significant concerns. The NFA requires all firms involved in trading and financial services within the US to comply with strict guidelines, ensuring they operate fairly and with transparency. Given that CenturyCrypto does not appear on the NFA register, its claimed US legitimacy seems misleading.

Transparency and Credibility Concerns

One of the primary issues with CenturyCrypto is its lack of transparency. The platform provides very limited information on its operational structure, management, or regulatory affiliations. Legitimate trading platforms are typically transparent about their credentials, registration, and compliance with industry standards to reassure investors. CenturyCrypto fails to meet these norms, making it challenging to trust its claims without verifiable information. This lack of transparency also indicates that the platform may have limited investor protections in place, adding to the potential risk.

Red Flags in CenturyCrypto’s Operations

Another area of concern is CenturyCrypto’s domain and online setup. The website lacks a professional polish typical of credible financial services, instead relying on high-profit claims and testimonials. This strategy is often seen on platforms that prioritize rapid fund acquisition over user security or service quality. Moreover, CenturyCrypto’s website lacks detailed financial content, resources, or educational materials, which are commonly offered by established platforms to support investors.

This limited content approach could suggest that the platform’s primary focus is on soliciting deposits rather than offering comprehensive and legitimate investment services.

High Risk and Investor Safety Concerns

For investors, entrusting funds to unregulated platforms like CenturyCrypto poses significant risks. In the event of disputes, platform closure, or irregular fund handling, investors on unregulated platforms have little recourse. Regulated brokers adhere to standards that protect client assets, including fund segregation and transparency practices, while unregulated entities lack these obligations.

CenturyCrypto’s lack of regulatory status also means that clients’ funds are not safeguarded, putting investors at risk of losing their investments. Without a governing body to hold it accountable, CenturyCrypto can change policies, delay withdrawals, or even halt operations without legal consequences, leaving investors with no protection.

Conclusion

CenturyCrypto lacks the regulatory credibility and transparency investors should seek in a trading platform. With an FCA warning and no NFA registration, CenturyCrypto fails to meet basic regulatory requirements for investor protection. These factors indicate substantial risks, and potential investors are strongly advised to avoid this platform.

In essence, CenturyCrypto operates without legitimate regulatory oversight, exposing users to unnecessary risk. For anyone considering investment options, it is wise to seek a regulated, transparent platform with a proven record of accountability and investor protection.

If you have already invested in CenturyCrypto and are having trouble withdrawing your funds, it is important to report the platform to your local financial regulatory body or Centered Reviews for a chance of recovery and to warn others..