CMC Finance Group, operating under the domain cmcfinancegroup.com, claims to offer a wide range of financial services and investment opportunities. According to its website, the company asserts that it is regulated by top-tier financial authorities such as the Financial Conduct Authority (FCA) in the UK, the Federal Financial Supervisory Authority (BaFin) in Germany, and the Italian Companies and Exchange Commission (CONSOB). However, a deeper investigation into these claims raises serious doubts about the legitimacy of the company.

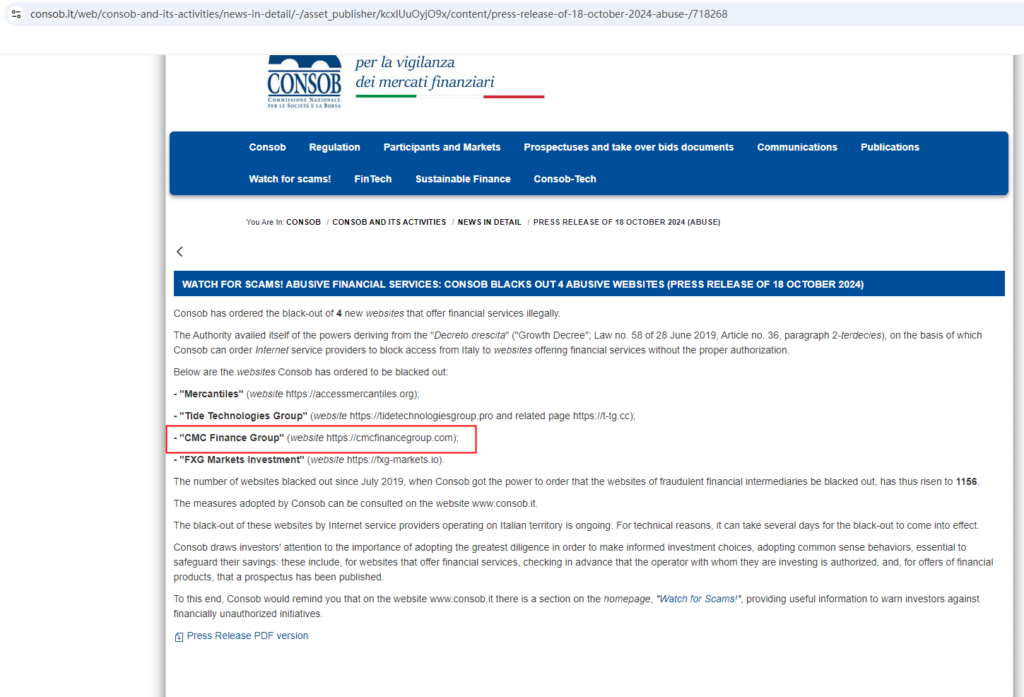

The Commissione Nazionale per le Società e la Borsa (CONSOB), which is Italy’s financial regulator, has issued an official warning against CMC Finance Group, stating that the company is providing financial services without the necessary authorization. You can view this warning here. The CONSOB warning should serve as a significant red flag for anyone considering investing through this platform.

False Claims of Regulation

One of the most concerning aspects of CMC Finance Group is its repeated claims of being regulated by prestigious financial authorities. On its website, the company states that it is authorized by the FCA, BaFin, and CONSOB. However, upon further investigation, these claims do not hold up. No records of CMC Finance Group can be found in the official databases of the FCA or BaFin. This alone is a clear indication that the company is not operating within the legal boundaries established by these financial authorities.

The fact that CONSOB itself has issued a warning about the company further confirms that CMC Finance Group is operating without proper oversight. In Italy, any company offering financial products or services must be registered and authorized by CONSOB. The failure of CMC Finance Group to meet this requirement means that it is likely engaging in illegal activities in the country.

CONSOB Warning and Its Significance

The CONSOB warning is a crucial piece of information that potential investors should not overlook. CONSOB is responsible for ensuring that companies offering financial services in Italy operate legally and transparently. When CONSOB issues a warning, it indicates that the company in question is not meeting the necessary regulatory standards and may be engaging in deceptive or fraudulent practices.

For CMC Finance Group, the CONSOB warning is a clear signal that the company is not authorized to offer financial services in Italy. Investors who engage with unregulated companies like this risk losing their money, as there are no legal protections or recourse available if the company engages in fraudulent activities or mismanages funds.

High Risk of Financial Loss

Investing in unregulated platforms like CMC Finance Group comes with significant risks. Without proper regulation, there are no guarantees that the company is handling investors’ money responsibly. Additionally, investors who lose money on such platforms have no recourse through regulatory bodies or compensation schemes like the Financial Services Compensation Scheme (FSCS) in the UK.

Fraudulent platforms often lure investors with promises of high returns, professional service, and security, but in reality, they are not subject to the same scrutiny and regulatory oversight as legitimate financial institutions. This makes it easy for them to mislead investors, disappear with funds, or manipulate trading results to their advantage.

Warning Signs of Fraudulent Activity

In addition to the CONSOB warning and the lack of proper regulation, there are other warning signs that CMC Finance Group may be a scam. The company’s website lacks transparency, with little information provided about its ownership, leadership, or business structure. This is a common tactic among fraudulent companies, as it makes it more difficult for regulators and law enforcement to track down the individuals responsible for running the operation.

Furthermore, the company’s claims of regulation by multiple authorities, while unsubstantiated, are another common tactic used by scams to build trust with potential investors. By falsely associating themselves with well-known regulatory bodies, these companies create a facade of legitimacy to attract unsuspecting clients.

Conclusion: CMC Finance Group is Likely a Scam

Based on the CONSOB warning, the lack of proper regulation by any recognized authority, and the numerous red flags surrounding its operations, it is clear that CMC Finance Group is a highly risky and likely fraudulent platform. Investors should steer clear of this company, as the risks of financial loss are substantial, and there are no legal protections in place to safeguard their money.

In conclusion, CMC Finance Group appears to be a scam, and potential investors are strongly advised to avoid engaging with this platform at all costs.

If you have already invested in CMC Finance Group and are having trouble withdrawing your funds, it is important to report the platform to your local financial regulatory body or Centered Reviews for a chance of recovery and to warn others..