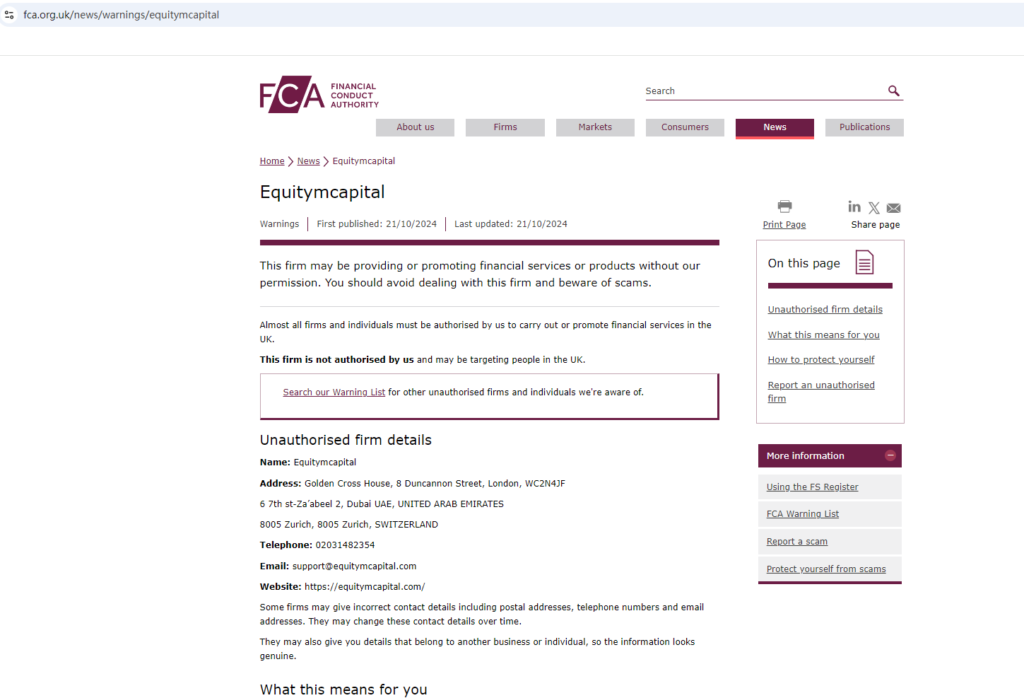

Equitymcapital.com promotes itself as a reliable investment platform, offering a wide range of financial services and claiming regulatory oversight from major global authorities. However, a closer investigation into the company’s credentials reveals significant concerns regarding its legitimacy. In fact, the United Kingdom Financial Conduct Authority (FCA) has issued an official warning against Equitymcapital, believing the company might be providing financial services or products without proper authorization in the UK. The FCA warning can be viewed here.

False Regulatory Claims

One of the most alarming aspects of Equitymcapital is its claim to be regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Australia Securities and Investment Commission (ASIC). These are two reputable financial regulators, and many legitimate firms seek their oversight to build investor confidence. However, upon investigation, no matching information could be found in the databases of either CySEC or ASIC regarding Equitymcapital.

The absence of these registrations indicates that Equitymcapital is not actually regulated by these agencies, despite its claims to the contrary. This tactic of falsely asserting regulatory oversight is a hallmark of fraudulent platforms, as it attempts to lure unsuspecting investors into a false sense of security.

FCA Warning and Lack of Authorization

The FCA is the primary financial regulator in the UK, and its warning against Equitymcapital is a significant red flag. According to the FCA, Equitymcapital is not authorized to offer financial products or services within the UK, and any claims it makes about being regulated are false.

The FCA warning is crucial because it underscores the risks involved in dealing with unregulated entities. Financial firms that operate without proper authorization are not held to the same standards as regulated ones. This means they may not be required to follow strict guidelines on fund segregation, client protection, and transparency. As a result, investors’ funds are at a much higher risk of being lost or misappropriated.

Website and Operational Concerns

Apart from its false claims of regulation, Equitymcapital raises several other red flags. The company provides minimal information about its operations, ownership, or physical location. Legitimate financial companies are transparent about their executive teams and office locations, but Equitymcapital offers none of these details, making it difficult for potential investors to verify the legitimacy of the company.

The website also includes suspiciously positive customer testimonials, which are often used by fraudulent platforms to boost credibility. These reviews lack specificity and are generally untraceable, further suggesting that they may be fabricated to mislead investors.

Risks of Investing with Unregulated Firms

Investing with an unregulated entity like Equitymcapital is highly risky. Without proper regulatory oversight, there are no mechanisms in place to protect investors if the company goes bankrupt or simply disappears. Additionally, unregulated firms are not required to keep client funds in segregated accounts, meaning that there is a higher risk of these funds being misused.

In many cases, platforms like Equitymcapital operate Ponzi schemes or other forms of investment fraud. Investors may initially see returns on their investments, but these payouts are often funded by new investors rather than actual profits. Eventually, these schemes collapse, leaving most investors with significant financial losses.

Conclusion: Equitymcapital is a Scam

In conclusion, Equitymcapital.com exhibits multiple characteristics of a fraudulent platform. From false regulatory claims to the warning issued by the FCA, there is overwhelming evidence that this company is not a legitimate financial services provider. Investors are strongly advised to avoid Equitymcapital and seek out regulated, transparent, and trustworthy investment opportunities instead.

If you have already invested in Equitymcapital and are having trouble withdrawing your funds, it is important to report the platform to your local financial regulatory body or Centered Reviews for a chance of recovery and to warn others..