CNMV Issues a Warning on FlareGain.io

On its website, FlareGain.io claims to offer a range of financial services and investment products, presenting itself as a global platform with offices in both the United Kingdom and Singapore. However, these claims are far from the truth. On 30 September 2024, the Comisión Nacional del Mercado de Valores (CNMV), Spain’s primary financial regulatory body, issued a formal warning against FlareGain.io. The CNMV stated that FlareGain was offering financial services and products without the required authorization.

This warning is significant because it highlights the platform’s illegal activities within the European market. Any company offering financial services must be authorized by regulatory bodies to ensure compliance with legal standards that protect investors. By failing to secure this authorization, FlareGain is operating outside of legal frameworks, leaving its clients vulnerable to fraud.

You can view the official CNMV warning here.

False Claims of Regulatory Oversight

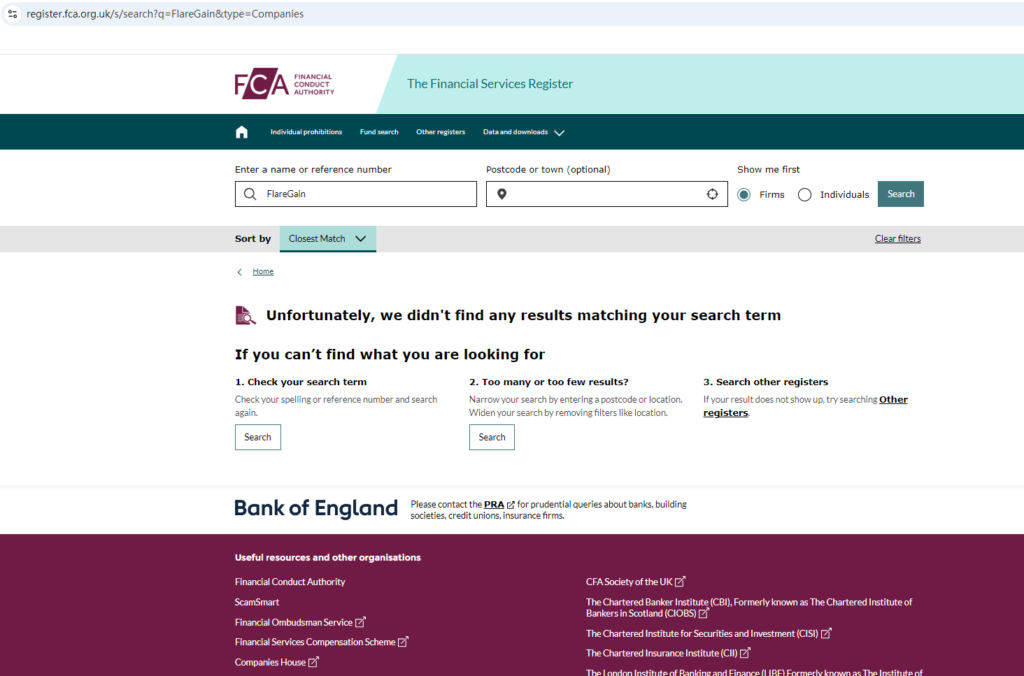

One of the most concerning aspects of FlareGain.io is its attempt to gain the trust of investors by claiming to be registered in two major financial hubs—the United Kingdom and Singapore. According to its website, FlareGain maintains offices in these locations and implies regulatory oversight from the respective authorities, the Financial Conduct Authority (FCA) in the UK and the Monetary Authority of Singapore (MAS).

However, upon investigation, no corresponding records were found to support these claims. FlareGain is not registered with the FCA, nor is it regulated by MAS. This lack of verifiable information about the company’s legal standing is a major red flag. A legitimate broker or financial institution would be transparent about its regulatory status and provide verifiable proof of its authorization to operate in these jurisdictions.

Without regulation, FlareGain operates without oversight, giving it the freedom to engage in unethical or fraudulent practices without fear of repercussions.

The Risks of Unregulated Investment Platforms

When dealing with an unregulated broker like FlareGain, investors are exposed to a myriad of risks. Regulated brokers are required to follow stringent rules, including the segregation of client funds, adherence to fair trading practices, and the availability of compensation schemes in case of fraud or insolvency. FlareGain.io, by contrast, offers no such protections.

Clients of unregulated platforms often report issues such as difficulty in withdrawing funds, account freezing, or total loss of their investments. Since FlareGain is not governed by any regulatory authority, investors have no legal recourse to recover their funds in case the platform decides to block withdrawals or vanish altogether.

False Promises and Red Flags

FlareGain also employs common scam tactics to lure in unsuspecting investors. It promises high returns with minimal risk, which is a telltale sign of a fraudulent operation. Legitimate investment platforms are transparent about the risks involved in trading, especially in volatile markets like Forex or cryptocurrencies. FlareGain, however, glosses over these risks, creating a false sense of security for investors.

Additionally, the website’s unprofessional design, vague company information, and lack of transparency about its team further reinforce the idea that FlareGain is not a trustworthy platform.

Conclusion: FlareGain.io is a Scam

In conclusion, FlareGain.io exhibits all the signs of a scam investment platform. With warnings from the CNMV, false claims of regulatory oversight, and a lack of transparency, it’s clear that FlareGain is designed to defraud investors. It is highly unsafe to entrust your money to this platform, as there are no legal protections in place to safeguard your funds.

Investors are strongly advised to steer clear of FlareGain.io and seek out regulated, reputable brokers that offer transparency, legal protections, and a safe trading environment. If you have already invested in FlareGain.io or suspect fraudulent activity, report the platform to your local financial regulatory authority or Centred Reviews and share your experience on review platforms like Trustpilot to warn others from falling victim to this scam.