Fortunex Algo claims to be a sophisticated trading platform that offers algorithm-based investment services. However, its recent emergence and lack of essential regulatory credentials cast significant doubt on its legitimacy. Registered only in May 2024, Fortunex Algo appears to use a basic website template, suggesting that it may be hastily established to attract investors without offering any true depth of services. Potential investors should carefully examine its claims and review the warnings issued against it by recognized financial authorities.

Regulatory Warning from CNMV

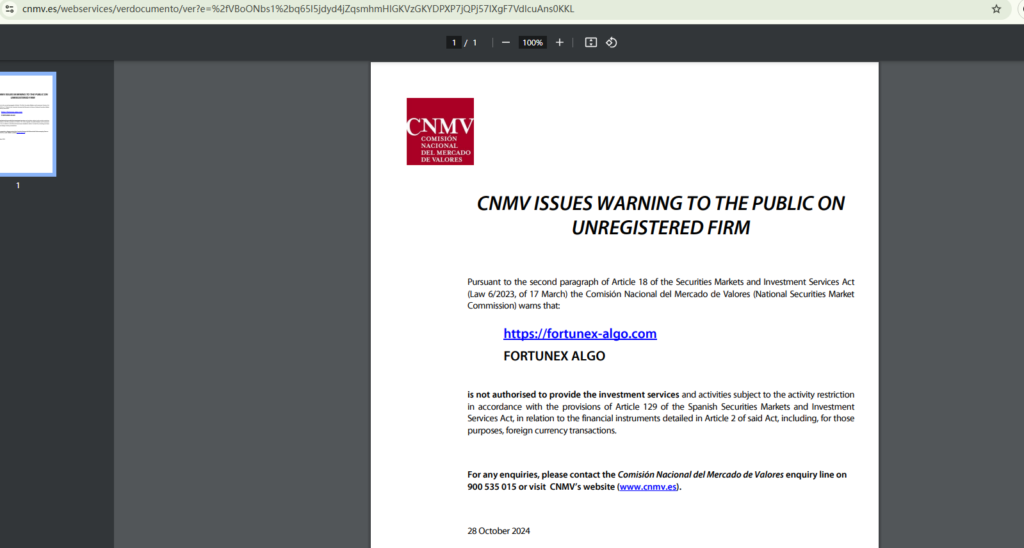

One of the most concerning aspects of Fortunex Algo is its absence of authorization to provide investment services. The Comisión Nacional del Mercado de Valores (CNMV), Spain’s primary securities regulator, has added Fortunex Algo to its warning list for offering investment services without proper licensing. You can view the official CNMV warning against Fortunex Algo here.

The CNMV’s inclusion of Fortunex Algo on its warning list serves as a critical alert for potential investors. Financial regulators issue these warnings to protect the public from fraudulent platforms that do not comply with regulatory standards. As Fortunex Algo is not licensed, it operates without any accountability to regulatory bodies. Therefore, if issues such as fund withholding or platform malfunctions occur, investors have no recourse for legal support or fund recovery.

Lack of Licensing and Company Information

Fortunex Algo fails to provide any meaningful company or regulatory information on its website, making it difficult to verify its legitimacy. Reliable trading platforms typically disclose their registration details, including licensing and headquarters locations. However, Fortunex Algo does not include any such details, creating a sense of ambiguity around its operations.

Without clear information regarding the company behind Fortunex Algo, investors cannot ascertain its credibility. The lack of transparency is a significant red flag, as legitimate companies are usually eager to display their credentials to gain investor trust. This platform’s failure to do so suggests it may be operating in a manner that does not prioritize investor safety.

Domain Registration and Platform Quality

Registered only recently in May 2024, Fortunex Algo has no established track record. The newness of its domain further highlights the platform’s potential risks. In the financial industry, platforms with longer histories tend to have a higher degree of trustworthiness, as they have survived scrutiny over time. A recently established website, especially one that offers financial services, should be approached with caution due to the lack of client reviews or historical performance data.

The platform’s design also raises questions. It appears to use a pre-made website template, suggesting minimal effort put into creating a unique or professional user experience. This lack of attention to detail might reflect the company’s general approach to conducting business, which does not inspire confidence.

High Risks and Investor Safety

Unregulated platforms like Fortunex Algo pose substantial risks for investors. The absence of regulation means there are no safety measures in place to protect client funds. Investors must be cautious when considering platforms that do not adhere to regulatory standards, as such platforms can easily misuse funds or deny withdrawal requests without facing legal repercussions.

Investing through Fortunex Algo exposes individuals to the potential loss of capital without any form of protection. Regulatory bodies like the CNMV have flagged the platform, yet Fortunex Algo continues to operate, likely relying on unsuspecting clients who have not encountered the warning.

Conclusion

Fortunex Algo lacks the transparency, regulatory credentials, and professional presentation required to establish itself as a credible investment platform. With the CNMV warning against it and its apparent disregard for providing valid company information, it appears high-risk and potentially fraudulent. Given these factors, it would be prudent for investors to avoid Fortunex Algo and seek investment options through regulated, trustworthy financial platforms.

In essence, Fortunex Algo does not offer the assurances needed for safe trading. Its unregulated status and lack of transparency make it an untrustworthy choice, placing investors’ funds at significant risk without any legal protections in place.

If you have already invested in Fortunex Algo and are having trouble withdrawing your funds, it is important to report the platform to your local financial regulatory body or Centered Reviews for a chance of recovery and to warn others..