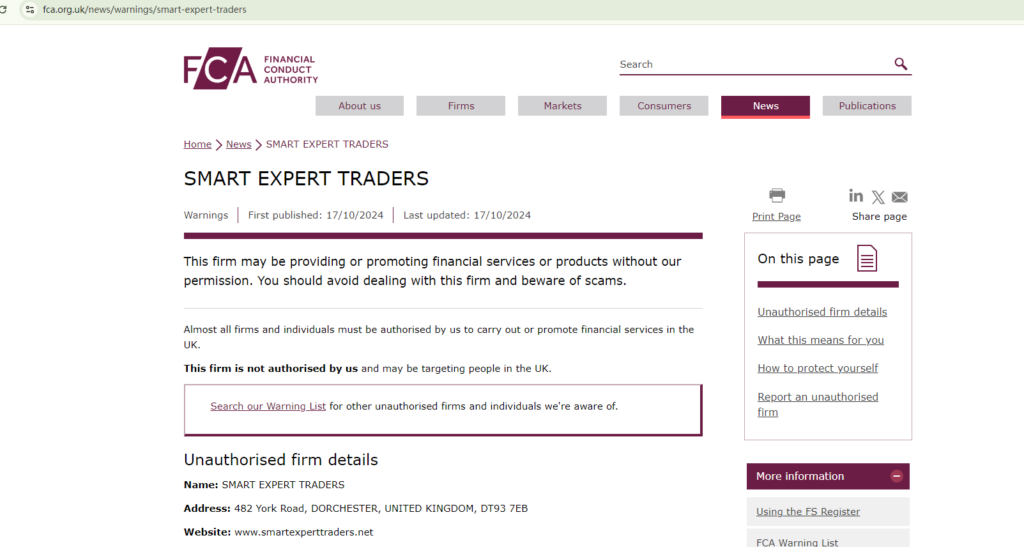

Smart Expert Traders is an online trading platform that has recently come under scrutiny for operating without proper authorization. The Financial Conduct Authority (FCA), the UK’s main financial regulatory body, has issued a warning against this firm, signaling that it may be providing financial services or products without the necessary approvals. You can view the official FCA warning here. This lack of regulatory oversight raises concerns about the legitimacy and trustworthiness of the platform.

Website Overview and Red Flags

Launched in April 2024, the Smart Expert Traders website presents itself as a platform for trading and investment opportunities. However, several warning signs suggest that it may not be a legitimate operation. For instance:

Lack of Transparency: There is no clear or valid regulatory information displayed on the website. Legitimate trading platforms typically display their licensing details prominently to reassure potential clients. Smart Expert Traders provides none, which is a major red flag for investors.

Suspicious Testimonials: The website features overly positive customer reviews and testimonials that appear fabricated. These glowing reviews aim to build credibility, but without verifiable identities or independent third-party reviews, these claims are questionable at best.

Anonymous Setup: The site provides no detailed company information, office address, or key personnel behind the operation. Companies that operate without disclosing their leadership or office locations are often fraudulent or engage in deceptive practices.

FCA Warning

The Financial Conduct Authority (FCA), known for safeguarding the interests of UK investors, issued a formal warning against Smart Expert Traders for operating without the necessary authorization. When the FCA issues such a warning, it strongly indicates that the company does not meet regulatory standards and could pose a risk to investors. By operating without authorization, Smart Expert Traders is not subject to the financial protections and oversight that UK investors would expect from a legitimate financial service provider.

Investors dealing with unregulated platforms like Smart Expert Traders lack legal protections. If the company fails to return funds or goes out of business, investors will have no recourse to recover their money. In the case of regulated firms, the FCA’s Financial Services Compensation Scheme (FSCS) and the Financial Ombudsman Service (FOS) provide avenues for compensation or dispute resolution, but no such protections exist for dealings with unregulated firms.

Typical Traits of Scam Platforms

Smart Expert Traders exhibits several warning signs that are commonly associated with scam platforms. These include:

New Domain Registration: The website was only registered in April 2024, a relatively short lifespan for a platform that claims expertise and reliability. Scam platforms often operate under new or short-lived domains to avoid detection and quickly disappear with investors’ funds.

Lack of Licensing: The platform does not possess any verifiable licenses from major regulatory bodies like the FCA, the Commodity Futures Trading Commission (CFTC), or the National Futures Association (NFA). The absence of such licensing means that the company operates without the safeguards required by law to protect clients’ investments.

Unrealistic Promises: Scam platforms often lure potential victims with the promise of high returns or guaranteed profits. While Smart Expert Traders’ website does not explicitly make these claims, the testimonials and vague descriptions of services imply an overly optimistic portrayal of its trading capabilities.

Investor Risks

Engaging with Smart Expert Traders poses significant risks. The platform is not subject to any regulatory oversight, meaning it could engage in fraudulent or unethical practices without facing any legal consequences. Investors who deposit funds on the platform have no legal recourse if the company fails to return their money, shuts down, or engages in other fraudulent activities. Additionally, without regulation, there is no guarantee that the platform’s trading activities are transparent, fair, or even real.

Conclusion: Smart Expert Traders is Likely a Scam

Based on the FCA warning and the various red flags outlined above, Smart Expert Traders appears to be a scam or, at the very least, a highly unreliable and unsafe platform for investors. The absence of regulatory oversight, the recent domain registration, and suspicious customer testimonials should be enough to discourage any potential investors from engaging with this firm. Investors are strongly advised to avoid Smart Expert Traders and only deal with fully authorized and regulated platforms that provide verifiable protection for their funds.

If you have already invested in Smart Expert Traders and are having trouble withdrawing your funds, it is important to report the platform to your local financial regulatory body or Centered Reviews for a chance of recovery and to warn others..