TradingRepublica.com claims to be an emerging global trading platform that offers access to various financial markets. While the platform markets itself as reputable and established, a closer inspection suggests otherwise. Trading Republica registered its domain in August 2024, meaning it lacks the longevity or history that more credible brokers have. Despite its new status, it attempts to convince potential investors of its legitimacy through claims of global presence and high-quality service. However, these assertions are not substantiated by genuine regulatory oversight, leaving significant doubts about the platform’s authenticity and reliability.

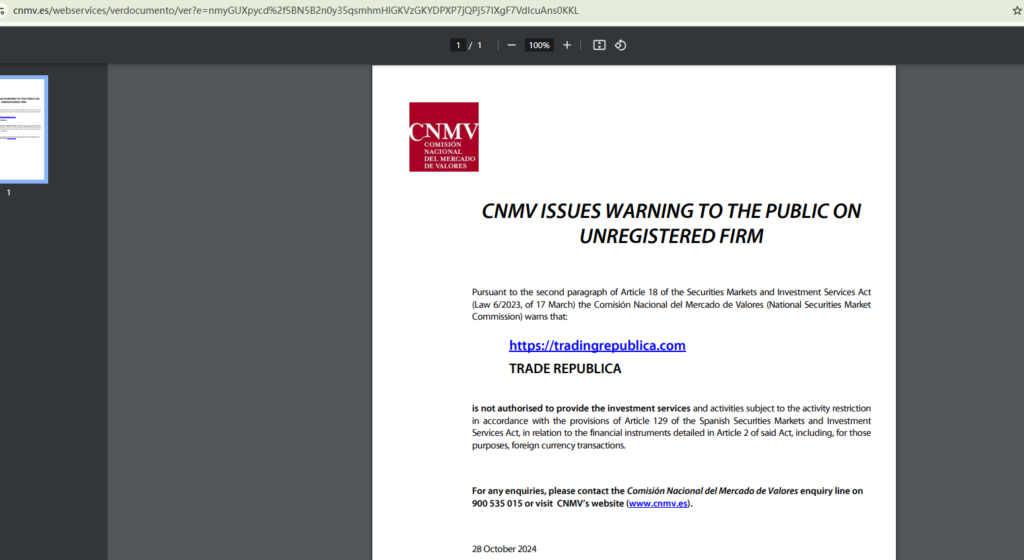

CNMV Warning

In October 2024, the Comisión Nacional del Mercado de Valores (CNMV), Spain’s main financial regulator, issued a warning regarding Trading Republica. The CNMV added the platform to its warning list for providing unauthorized investment services. This classification means that Trading Republica is not licensed to operate in Spain or within the European Union and lacks the legal authorization to offer its financial services to Spanish or EU investors. This regulatory warning can be reviewed on the CNMV’s official site here.

This alert should be a significant concern for potential investors. A warning from a respected financial regulator like the CNMV implies that the platform may be involved in unauthorized or fraudulent activities. Given these risks, investors are strongly advised to avoid using Trading Republica and to consider safer alternatives with established regulatory credentials.

Misleading Regulatory Claims

One of the most notable red flags on TradingRepublica.com is its reliance on a certificate from FISEU, which it presents as evidence of legitimacy. However, FISEU is not a recognized financial regulatory body. Instead, it has been flagged as a fraudulent entity by BaFin, Germany’s financial supervisory authority. The use of this certificate is misleading, as it falsely implies a level of legitimacy that the platform does not hold. This misrepresentation casts further doubt on the integrity of Trading Republica, indicating that the platform may be willing to deceive potential clients to gain their trust.

In addition to the fake FISEU certification, Trading Republica offers no details of genuine registration with any recognized financial authority, such as the Financial Conduct Authority (FCA) in the UK or the Cyprus Securities and Exchange Commission (CySEC). This lack of verifiable oversight leaves users highly exposed to potential fraud or unfair practices without any protective recourse.

High-Risk Factors

Several additional elements increase the risks associated with Trading Republica:

Recent Domain Registration: Trading Republica’s domain was registered only recently, suggesting that it lacks any established history or track record of reliable service.

Vague Operational Information: The platform provides minimal information about its headquarters, management team, or operational details. This lack of transparency is a common tactic among unregulated brokers seeking to avoid accountability.

Questionable Client Reviews: The few online reviews available for Trading Republica are generally negative, with several users claiming difficulty in withdrawing their funds or encountering unresponsive customer service.

Absence of Contact Information: Legitimate brokers often provide comprehensive contact details, including phone numbers, email addresses, and physical office locations. Trading Republica, however, lacks this basic transparency.

Implications for Investors

Entrusting funds to an unregulated and deceptive platform like Trading Republica exposes investors to significant risks. Without regulatory oversight, there are no measures in place to protect investors if the platform engages in unethical or fraudulent activities. Additionally, the lack of reliable contact information and operational transparency means users have limited means of recourse if they encounter issues.

Investors are strongly advised to avoid Trading Republica and instead seek out regulated brokers with proven reputations and licensing from trusted authorities such as the FCA, ASIC, or CySEC. Choosing a broker with a legitimate regulatory foundation ensures a higher degree of protection and accountability.

Conclusion

In summary, Trading Republica shows multiple red flags indicating that it may not be a trustworthy platform. With a recent CNMV warning, fake regulatory claims, and a lack of transparency, Trading Republica does not provide the safety and reliability investors should expect. Engaging with this platform could lead to financial losses without any recourse, making it a risky choice for potential investors.

If you have already invested in Trading Republica and are having trouble withdrawing your funds, it is important to report the platform to your local financial regulatory body or Centered Reviews for a chance of recovery and to warn others..