Vestor Premier positions itself as a prominent financial services provider, boasting a range of investment opportunities aimed at attracting investors. The website presents an appealing narrative, suggesting that it offers sophisticated trading platforms and various financial products. However, upon closer inspection, several concerning issues arise that warrant careful scrutiny before entrusting any funds to this company. The absence of transparency and the mounting warnings from regulatory bodies indicate potential risks that could significantly affect investor safety and trust.

FCA Warning and Regulatory Concerns

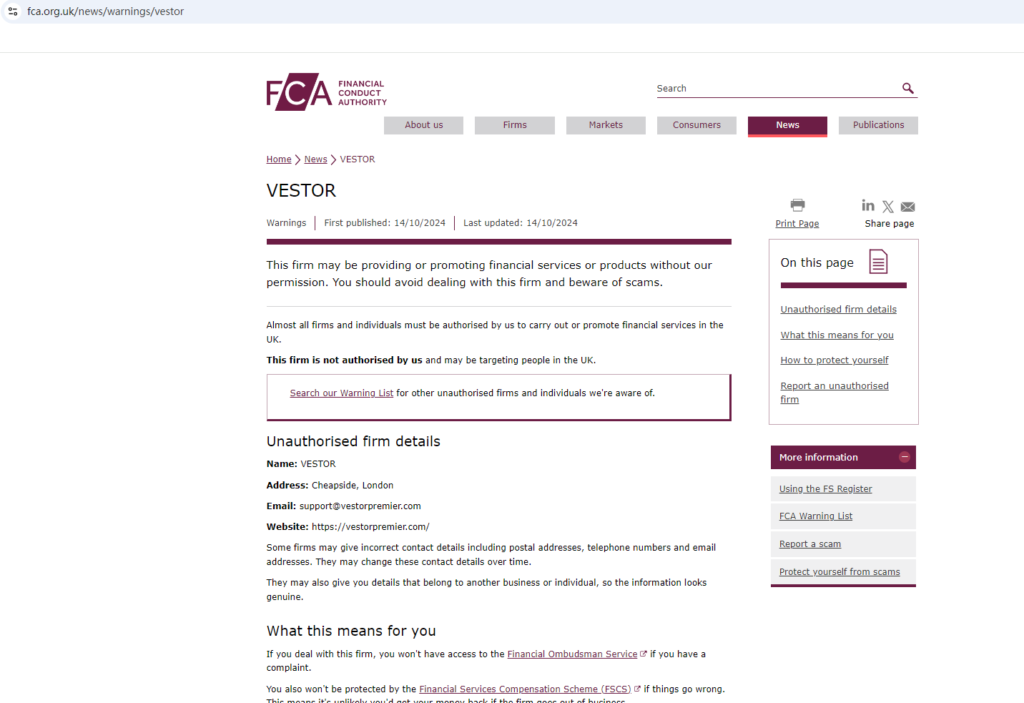

One of the most alarming developments regarding Vestor is the warning issued by the Financial Conduct Authority (FCA) in the UK. The FCA has explicitly stated that Vestor may be operating without the necessary authorization to provide financial services or products within the UK. This is not a minor issue; it raises serious questions about the legitimacy of Vestor’s operations. Regulatory bodies like the FCA exist to safeguard consumers from potentially harmful practices in the financial sector. Their warnings are not issued lightly and should serve as a critical alert for potential investors. For more details, you can view the FCA’s warning here.

In the financial world, regulation plays a crucial role in protecting consumers. Authorized firms are held to high standards of conduct, ensuring that they operate with integrity and accountability. In contrast, firms operating without proper authorization may not adhere to these standards, which puts investors at significant risk. When a reputable regulatory body raises concerns about a financial institution, it is essential for prospective investors to take these warnings seriously.

Lack of Transparency

Vestor’s website makes bold claims about being regulated in multiple jurisdictions. However, it conspicuously lacks detailed and specific regulatory information. This omission is a major red flag. A trustworthy financial institution should be transparent about its regulatory status, readily providing license numbers and links to the governing bodies that oversee its operations. In Vestor’s case, the absence of this critical information raises serious suspicions about the validity of its claims. Investors should be asking themselves why Vestor does not offer clear evidence of its regulatory compliance.

Transparency is a cornerstone of trust in the financial industry. When companies fail to provide clear information about their regulatory status, it can create an atmosphere of uncertainty. Potential investors might feel compelled to proceed without understanding the risks involved, which can lead to disastrous financial consequences.

Risks of Unregulated Investment

The FCA’s warning further indicates that Vestor may not have the necessary legal framework in place to protect investors’ funds. This absence of regulation poses significant risks to anyone considering investing with this company. Without proper oversight, there are no guarantees that Vestor will operate with the level of integrity expected from a legitimate financial institution.

Investors who choose to trust Vestor with their funds may find themselves vulnerable to various threats, including scams, fraud, or mismanagement of their investments. The lack of a regulatory safety net means there are no legal protections in place to safeguard investor funds. If Vestor were to engage in unscrupulous practices, investors could face challenges in recovering their money or seeking recourse.

This situation underscores the importance of conducting thorough due diligence before engaging with any financial service provider. Investors should carefully examine the regulatory status and track record of any company they consider working with. Rushing into an investment without this crucial information can lead to severe financial repercussions.

Conclusion: A Company to Avoid

In conclusion, Vestor Premier raises significant concerns that merit serious consideration. The FCA’s warning about the company’s potential unauthorized operations serves as a critical alert for anyone contemplating an investment. The absence of detailed regulatory information further erodes confidence in Vestor’s legitimacy, making investing with them a considerable risk.

Potential investors should prioritize safety and transparency when making financial decisions. Conducting thorough research and seeking alternatives with verified regulatory compliance is essential. Given the available information and the significant red flags surrounding Vestor Premier, it seems prudent to approach this company with caution and skepticism.

If you have already invested in Vestor Premier and are having trouble withdrawing your funds, it is important to report the platform to your local financial regulatory body or Centered Reviews for a chance of recovery and to warn others..