Vitrontrades.com presents itself as a British investment company established in 2016, claiming to have an operational base in the United States. Its website projects an image of a long-standing, reputable financial institution, which is intended to attract potential investors. However, upon closer examination, multiple inconsistencies and red flags emerge that question its legitimacy. Most notably, Vitrontrades’ lack of any credible regulatory status, suspicious registration details, and misleading information about its certifications raise serious concerns.

Regulatory Concerns

One of the main issues with Vitrontrades is its apparent disregard for regulatory compliance. Despite its claims to be a British company, there is no record of Vitrontrades in the UK’s Financial Conduct Authority (FCA) registry. Any legitimate financial or investment company operating from the UK must register with the FCA, as this ensures compliance with local laws and protection for investors. The absence of an FCA registration suggests that Vitrontrades is not authorized to provide investment services in the UK.

Similarly, Vitrontrades claims to have operations in the United States, where it should ideally be registered with the National Futures Association (NFA) to conduct trading or investment activities. However, a thorough check of the NFA’s database shows no mention of Vitrontrades, casting doubt on its claims of regulatory legitimacy. This lack of regulatory oversight makes Vitrontrades a high-risk choice for investors, as it has no accountable body ensuring it operates fairly or within legal boundaries.

Misleading Website Claims

Vitrontrades presents itself as a company founded in 2016, but a quick investigation reveals that its website domain was only registered in 2024. This discrepancy raises questions about the authenticity of its claims regarding operational history and experience. A company established as recently as 2024 lacks the historical track record needed to build trust and credibility with investors. Such a misleading claim of being in operation since 2016 suggests an attempt to appear more established than it truly is.

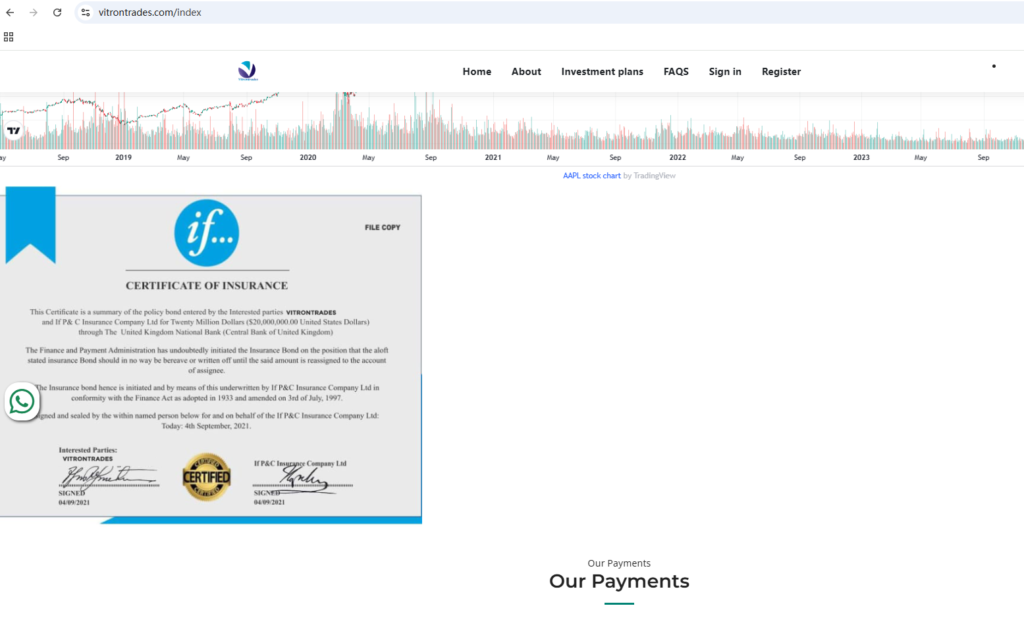

Additionally, Vitrontrades displays a certificate on its website, which it implies as proof of regulatory compliance. However, this certificate is found to be related to the insurance industry and holds no authority to regulate forex or investment activities. Using this irrelevant certificate as a credibility booster is highly deceptive, and it may mislead inexperienced investors into thinking the platform is regulated and trustworthy.

High Risks and Lack of Protection for Investors

Investing with an unregulated broker like Vitrontrades poses substantial risks. Without proper regulation, Vitrontrades is not held accountable by any financial authority, meaning it can operate with little to no transparency. Investors have no assurance that their funds will be handled responsibly or securely. Should Vitrontrades deny withdrawals, close accounts, or engage in other questionable practices, affected investors would have no legal recourse or support to recover their funds.

Moreover, the lack of transparency about its terms of service, fee structure, and policies adds to the risk. Reliable brokers typically provide detailed terms and policies that allow investors to understand potential costs and withdrawal conditions. However, Vitrontrades has not provided this information clearly, leaving investors vulnerable to unexpected fees and withdrawal limitations.

Conclusion

Vitrontrades exhibits several concerning characteristics commonly associated with fraudulent or high-risk investment platforms. The lack of registration with the FCA or NFA, misleading information about its operational history, and irrelevant certificates all suggest that it may not be a legitimate investment platform. Investors are advised to steer clear of Vitrontrades, as there are no regulatory protections or credible assurances that funds will be managed ethically or securely.

In summary, Vitrontrades appears to lack the regulatory status and transparency needed to ensure safe investment practices. Avoiding unregulated platforms like Vitrontrades is advisable, as they expose investors to significant risks with minimal safeguards or legal protection in place.

If you have already invested in Vitrontrades and are having trouble withdrawing your funds, it is important to report the platform to your local financial regulatory body or Centered Reviews for a chance of recovery and to warn others..