Wealthmaximizertrade presents itself as an online trading platform, offering financial services to investors globally. However, upon closer inspection, several red flags have surfaced that suggest Wealthmaximizertrade may not be the legitimate and trustworthy platform it claims to be. Most notably, the United Kingdom Financial Conduct Authority (FCA) has issued a warning against the platform, stating that it might be providing financial services or products without proper authorization in the UK. This review will examine the key issues surrounding Wealthmaximizertrade, including its lack of regulation, dubious claims of global oversight, and absence of crucial company information, which all contribute to its potential for being a scam.

FCA Warning: Wealthmaximizertrade Operating Without Authorization

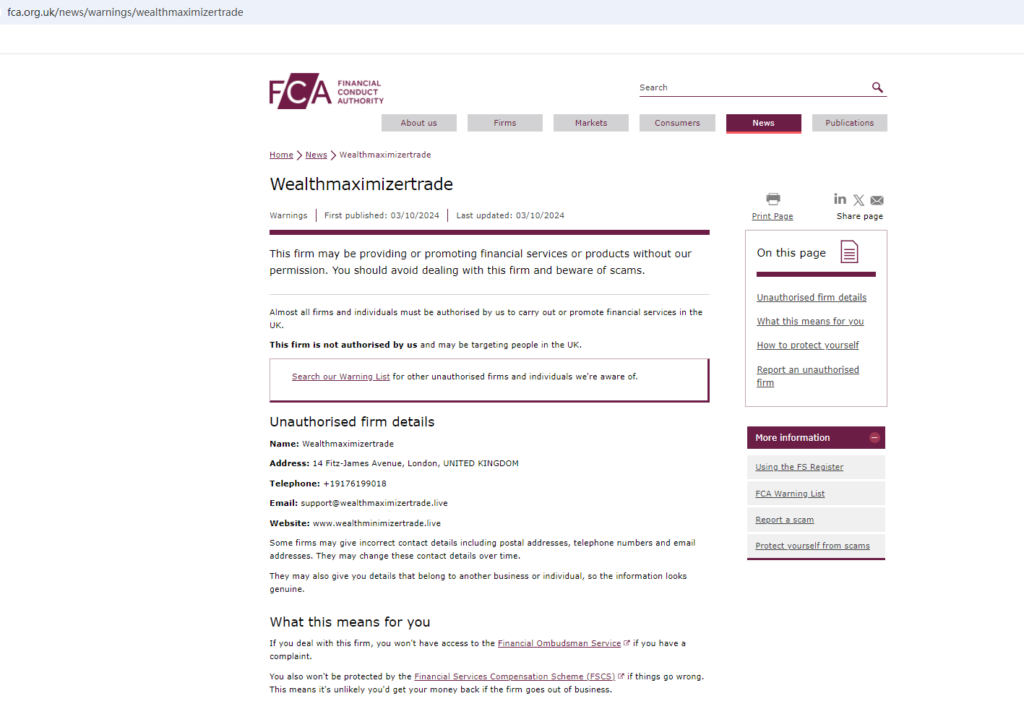

The FCA, the UK’s foremost financial regulatory body, has flagged Wealthmaximizertrade as a platform potentially operating without the necessary authorization. This is a major red flag for anyone considering investing with this broker. In the UK, all firms providing financial services must be registered and authorized by the FCA to ensure they adhere to strict guidelines that protect consumers. This includes maintaining transparency, ensuring fair trading practices, and keeping client funds safe in segregated accounts.

The absence of FCA authorization means that Wealthmaximizertrade is not subject to these regulations, making it highly risky for investors. Without oversight, the platform can engage in unethical practices, such as manipulating trades, refusing withdrawals, or disappearing with investors’ money. This warning is a clear indication that investors should be cautious and avoid dealing with Wealthmaximizertrade. The FCA’s official warning can be accessed here.

Lack of Valid Regulatory Information

One of the most alarming aspects of Wealthmaximizertrade is its claim to be regulated globally, without providing any verifiable evidence to back this up. A legitimate investment platform will typically display its regulatory credentials prominently on its website, including the names of the regulatory bodies overseeing its operations, registration numbers, and other relevant details. However, Wealthmaximizertrade fails to display any such information, leaving investors in the dark about the company’s legal standing.

Moreover, the platform does not even provide basic company details such as a physical address or a phone number. This level of anonymity is highly concerning, as it suggests the company may be trying to hide its true identity from regulators and investors. A lack of transparency in key areas like regulation and contact information is a hallmark of fraudulent investment platforms.

False Claims of Global Regulation

In addition to failing to provide valid regulatory information, Wealthmaximizertrade makes broad claims of being “globally regulated.” However, this is clearly unsubstantiated, as there is no evidence of the platform being registered with any credible regulatory authorities, whether in the UK or other jurisdictions. A quick investigation into major financial regulators like the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Securities and Exchange Commission (SEC) in the United States shows no records of Wealthmaximizertrade being regulated by these institutions.

False claims of global regulation are a common tactic used by scam brokers to lure in unsuspecting investors. By pretending to be regulated, these platforms aim to gain credibility and convince traders to deposit their money, only for them to face difficulties when attempting to withdraw funds or manage their accounts.

Investor Risks and Lack of Protection

The lack of regulatory oversight for Wealthmaximizertrade means that investors’ funds are not protected by any legal mechanisms. Reputable, regulated brokers are required to adhere to strict rules, including segregating client funds from the company’s operational accounts and offering compensation schemes in the event of insolvency. Wealthmaximizertrade, on the other hand, operates outside these frameworks, leaving investors completely exposed to the risk of losing their funds with no avenue for recourse.

Conclusion: Avoid Wealthmaximizertrade

In conclusion, Wealthmaximizertrade is an unregulated and potentially fraudulent platform that should be avoided at all costs. The FCA warning, lack of valid regulatory information, false claims of global regulation, and absence of basic company details all point to a high likelihood that this platform is a scam. Investors are strongly advised to stay away from Wealthmaximizertrade and instead choose brokers that are transparent, properly regulated, and offer robust protections for their clients.

If you have encountered issues with Wealthmaximizertrade or suspect that you have been scammed, it is important to report the platform to your local financial regulatory authority or Centered Reviews for chance of recovery and to help warn others.